The USDA came out with their WASDE report yesterday with their expectations for the 2021 year. Overall for the cattle markets show a lower price target for the first quarter of 2021 while the Q2 expectations for supply look to dry up and production looks to slow down and a rise going forward. The actual projections for Q2 production were lowered 1.8% and this seems to reflect the OCT cattle on feed placement number. The supply projections seem to be in line with the fed cattle values, which look strong come next spring. They do raise the question of what South America will do in terms of import numbers. With COVID restrictions possibly in play, come Feb 1st we will have a clearer picture of what our relationship with China will be, which would answer some questions as far as the demand coming from them.

Although a possible vaccine for COVID seems like it is coming and people do expect the demand to increase because of that, but it doesn’t seem to carry much weight/or have that much of an impact that would change the outlook for the overall market production. The USDA estimated cattle slaughter came in at 120,000 head yesterday. This brings the total for the week so far to 474,000 head, down from 481,000 last week and down from 491,000 a year ago. US beef export sales for the week ending December 3 came in at 2,989 tonnes for 2020 and 12,028 for 2021 for a total of 15,017. This was down from 16,912 the previous week and a four-week average of 19,416. In Nebraska 1,962 head traded at 106-107 and an average price of 106.54, down from an average of 109.88 last week and 110.64 the week before that.

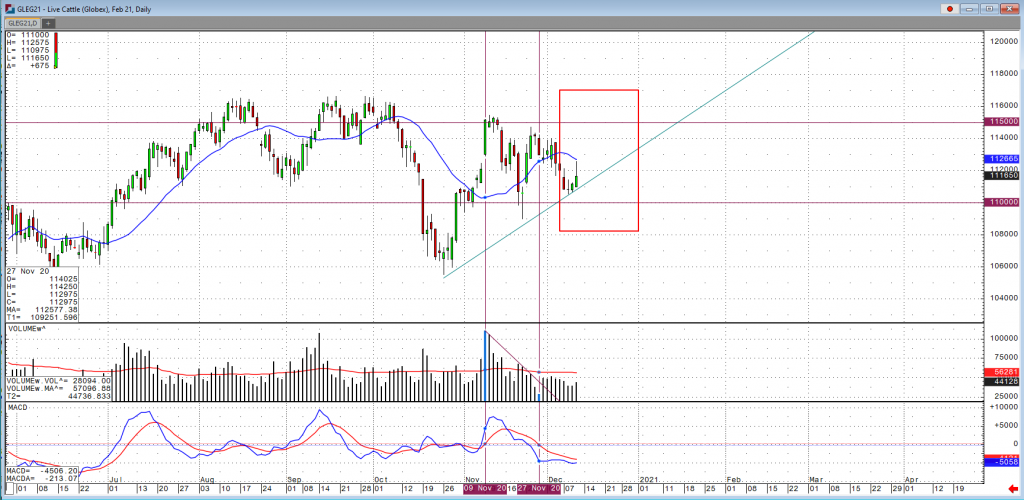

If Feb futures breakdown below the $110 level we could see the basis narrow and trade near the $108 level. The near-term resistance $114 but the $116 level has shown to be very strong resistance so if by chance we even get through $114 there would have to be pretty drastic change in supply for Feb cattle to trade above $116.