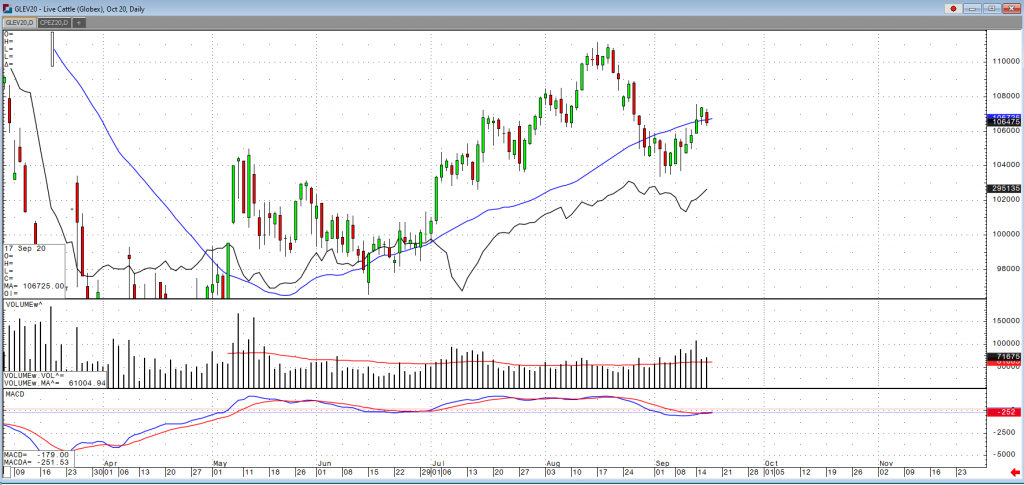

October live cattle rallied a bit yesterday to its August 21st highs as it continues to push towards the August monthly highs of 110. Cash prices continue to trend lower but technical action remains bullish. The market is still bracing for the outlook of production to be increasing in the near term. Cash live cattle are firming up a bit this week. In Kansas on Wednesday, 9,967 head were reported at $100-$103 and an average price of $102.86, up from $101 last week. In Texas/Oklahoma 2,119 head traded at $103-$103.5 and an average price of $103.25, up from $101.81 last week. The USDA estimated cattle slaughter came in at 120,000 head yesterday. This brings the total for the week so far to 360,000 head, up from 241,000 last week, and up from 356,000 a year ago. The USDA boxed beef cutout was down $1.01 at mid-session yesterday and closed 71-cents lower at $215.38. This was down from $222.95 the previous week and was the lowest the cutout had been since August 14. The premium the futures have to the cash market is a little concerning even though we have seen some strong technical price action in the near term. Something to consider would be doing a synthetic strategy of shorting a futures and buying a call option with a delta of 50%.