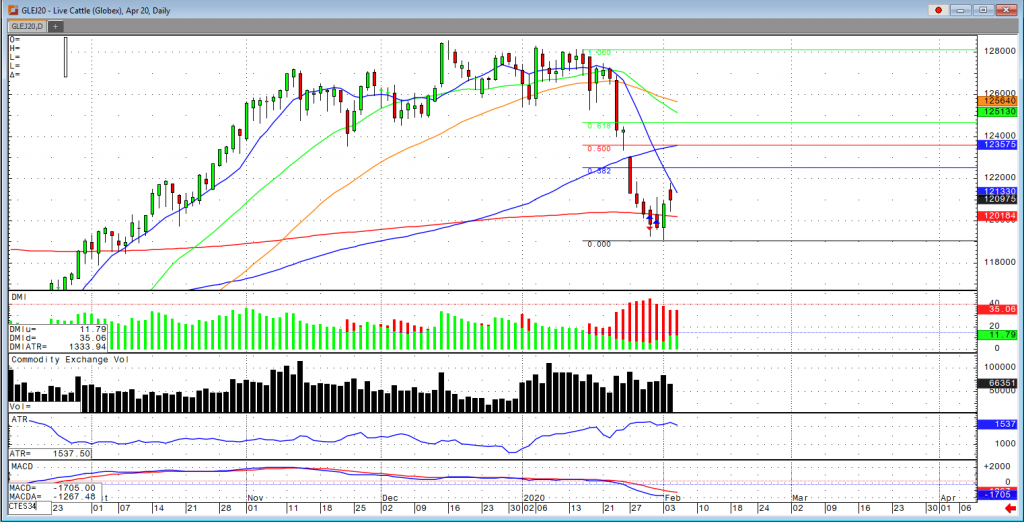

The April live cattle contract gapped open yesterday but eventually traded lower to fill the gap putting in a low for the day at 120.45 then eventually closing at 120.97. During the trading session, the high it made on the day was 121.80 which was right at the 10-day moving average before eventually finishing lower. Near term supply looks to be in abundance due to record beef production and aggressive slaughter numbers. Coronavirus played a huge role in this market when the news first came out with the scare essentially depleting demand. It seems that the bottom has been put in for cattle around the 120 level, but looking at the open interest we could see some more long liquidation. I’d like to see the market take out yesterday’s high and close above the 10 DMA, if that happens then I would suspect that the market would make a run to the 123-123.50 level to fill that gap made back on Jan 27.

With April fats trading lower on the day but with less volume than on Monday, it gives me an indication that this was just some profit taking along with the market making a successful effort to fill the gap it made on the open. I am targeting this market to be trading at 123-125 by the end of the month and into March. The USDA estimated cattle slaughter came in at 122,000 head yesterday. This brings the total for the week so far to 243,000 head, up from 239,000 last week and up from 237,000 a year ago. There was no trade in cash live cattle yesterday after prices traded roughly $2 lower last week.