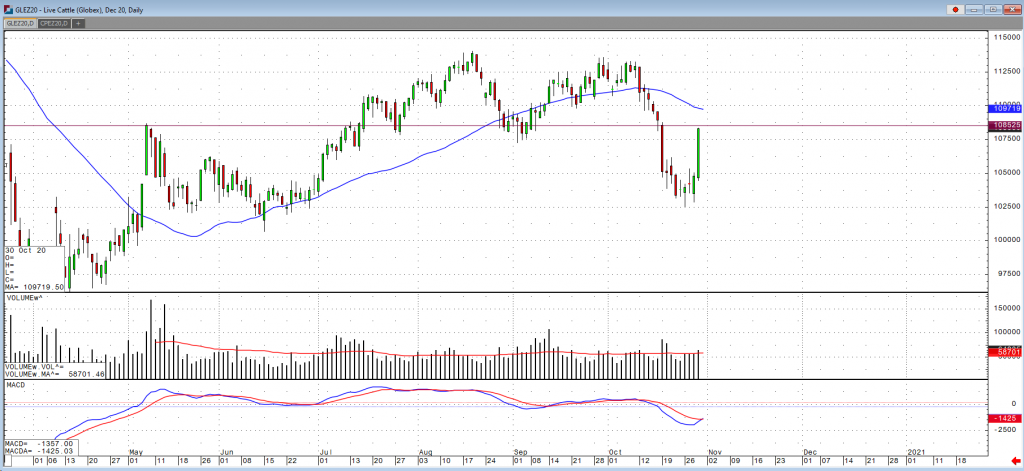

Dec cattle, and the cattle market as a whole experienced a nice rally yesterday with the December contract closing at 108.30. If we do get some follow through today, the market will run into some pretty strong resistance at these 108.50 levels. If it breaks though that, with above average volume I would then look go long. What was helping this little rally yesterday was a more stable cash trade, as cash was mixed from lower, unchanged, and higher prices but also the slowdown in production has helped boost prices as well. Exports seemed to have been a bullish report as well as you can see in the numbers below. With increased virus concerns though and potentially more cities and countries shutting down do to COVID, we could see demand drop drastically again resulting to a fall in prices.

The USDA boxed beef cutout was up $1.50 at mid-session yesterday and closed $1.38 higher at $207.17. This was down from $208.86 the previous week. US beef export sales for the week ending October 22 came in at 18,853 tonnes for 2020 delivery and 4,594 for 2021 for 23,447. This was down slightly from the previous week’s 24,307 but above the average of the previous four weeks at 21,756. Cumulative sales for 2020 have reached 838,038 tonnes, up from 797,428 last year at this time but down from 840,150 two years ago. The five-year average is 714,885. The largest buyer this week was Japan at 6,907 tonnes for 2020 and 2021 combined, followed by South Korea at 5,258 and China at 4,280. Japan has the largest commitments for 2020 at 242,381 tonnes, followed closely by South Korea at 227,612. China is in sixth place at 47,109. The USDA estimated cattle slaughter came in at 114,000 head yesterday. This brings the total for the week so far to 464,000 head, down from 480,000 last week and 465,000 a year ago.