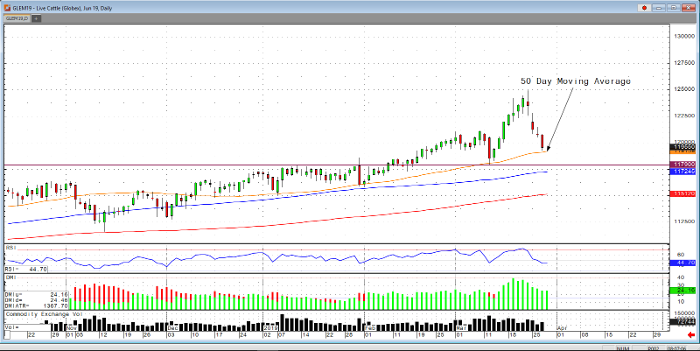

Yesterday had continued selling in the June live cattle contract, as it closed at 119550. The weakness is coming from the cash market and a downturn in open interest. Looking ahead, the supply of cattle on feed is at a record high, while the market ready cattle numbers look to increase in the nearby months. The June contract has reached its lowest level since March 13th. The forecast for the plains is dry weather which also triggered the long liquidation. I suspect the market to continue to sell-off, passing through the 50-day moving average to the 117900 support level. The USDA estimated cattle slaughter came in at 120,000 head yesterday. This brings the total for the week so far to 358,000 head, up from 355,000 last week. and up from 352,000 a year ago. USDA boxed beef cutout values were down 70 cents at mid-session yesterday and closed 52 cents lower at $228.99. This was up from $228.67 the prior week. Cash cattle trade was fairly active in Kansas, at $126, down $2.00 from last week.

Lean Hogs seem to have plenty of short-term supply and with the USDA Hog and Pig report, it is likely to show that there will be more expansion and more record supplies. The main issue would be the demand level from China and how much they are going to buy. In December, the total U.S. exports reached 526 million pounds, if these numbers continue then we are likely to see monthly exports jump 50% for some time. The USDA estimated hog slaughter came in at 477,000 head yesterday. This brings the total for the week so far to 1.422 million head, up from 1.409 million last week, and up from 1.384 million a year ago.

Live Cattle Jun ’19 Daily Chart