Fats have been having a tough time the past couple months as NET longs continue to liquidate their positions. There is no incentive for traders to be pushing the basis wider in the lives so any advantage that the sellers had in this market is gone. Cash seems to be holding strong for a little bit as cash cattle traded as low as $110.00 in Nebraska on Monday and traded $111 to $114 yesterday with a weighted average of $113.58. Texas traded both days this week at $113.00, down from $115 last week and Kansas has traded between $111 and $113 this week. Overall, yesterday, the market had a nice recovery in the August contract. There has been a case of mad cow disease in Brazil, meaning China needs to give approval before resuming any exports. Most expect the largest importer of beef, China, will allow the imports to resume.

Another laggard in this market is that there was weak spring demand for grilling season due to the poor weather, making traders worry that this seasonal demand cannot be recovered and that the market will still be feeling pressure from that. The USDA estimated cattle slaughter came in at 120,000 head yesterday. This brings the total for the week so far to 241,000 head, up from 124,000 last week and up from 239,000 a year ago. USDA boxed beef cutout values were up 37 cents at mid-session yesterday and closed 20 cents lower at $223.00. I expect the market to trade sideways for the rest of the week to up as, even though there is no real sign of a technical low, the market is oversold and could bounce up to the resistance level of 105.150.

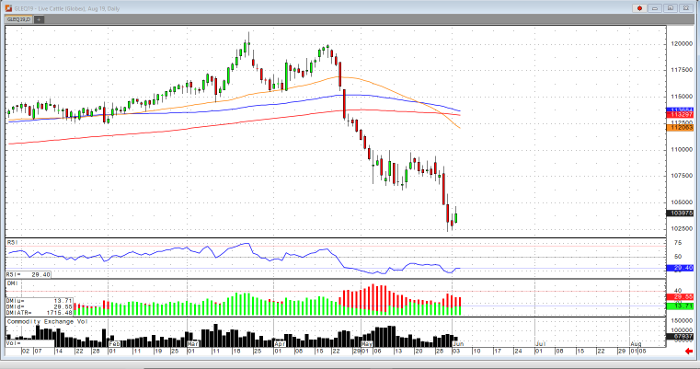

Live Cattle Aug ’19 Daily Chart