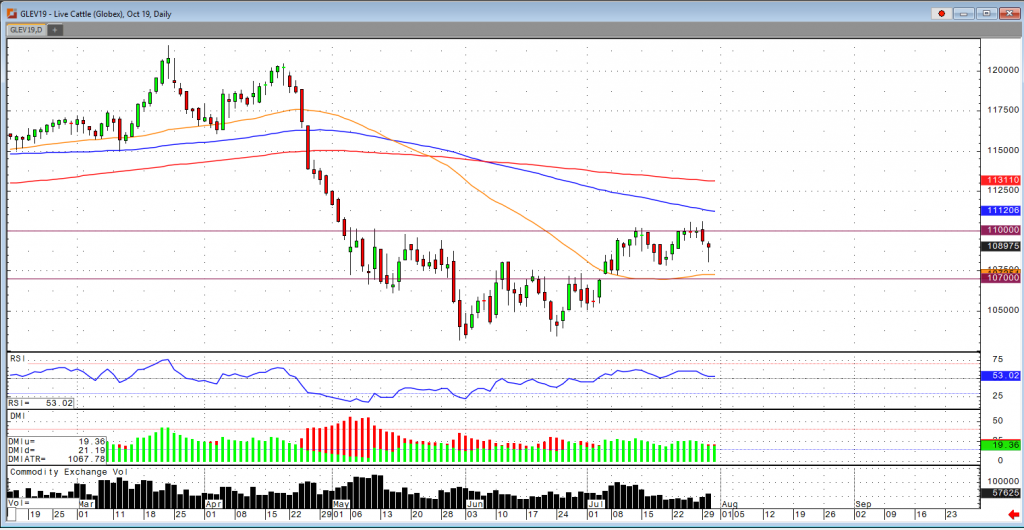

October live cattle have been mostly trading sideways for the week with exception of the past two trading days. Cash cattle traded a little higher last week which could bring some support to the market for the rest of this week. There was no breakthrough of the $110.00 level, but conversely there was no major sell-off to the $107.00 level like I suspected would happen. Supply should tighten later this year with 1st quarter production seeing a much larger drop then 4th quarter which would help drive Feb cattle prices up. One of the factors putting pressure on this market is the idea that export news is negative along with the high short-term beef supply coupled with weak demand for August. Since there was no violation of the $110.00 resistance then I suspect prices to trend lower and stay between the $107-$110 range. USDA boxed beef cutout values were up $1.20 at mid-session yesterday and closed 77 cents higher at $214.03. This was up from $213.78 the prior week and the highest since July 10th. Cash markets last week were firm with Kansas trade at a weighted average price of $111.98 and Texas at $111.96, up about $1.00 from the previous week. Nebraska traded at $114.78 from $114 the previous week.

The hog market saw aggressive selling the past couple days, as the market lost roughly $8 over the past 4 days due to fears of the U.S./China trade talks falling through. Chinese pork production is expected to decrease by 8% while the imports are expected to rise at least 40% year over year. USDA pork cutout values, released after the close yesterday, came in at $85.37, up $2.67 from Monday and up from $79.46 the previous week. This is the highest pork value since May 21st. The CME Lean Hog Index as of July 26th was 80.36, up 1.50 from the previous session and up from 73.27 the week prior. The USDA estimated hog slaughter came in at 470,000 head yesterday. This brings the total for the week so far to 922,000 head, down from 948,000 last week, but up from 891,000 a year ago.