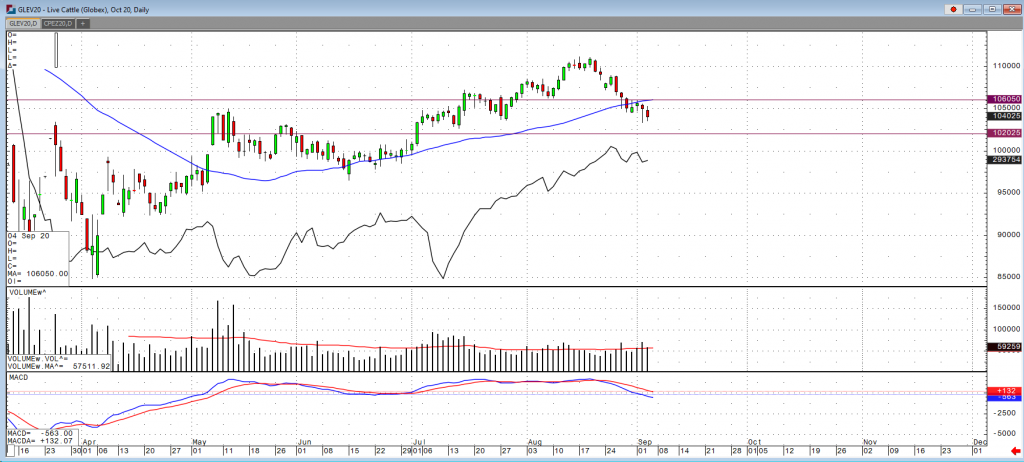

Fat cattle is still in a downtrend overall and if this trend continues, we will start to see the premium being held in the Oct contract diminish to the cash market. Right now, feedlots are stocked with market ready cattle along with the availability of those feedlots to move feeder cattle. One thing to consider would be if the slaughter numbers for September comes in below what we are expecting, then the high weight problem could cause these prices to rally. The USDA boxed beef cutout was down 67 cents at mid-session yesterday and closed 34 cents lower at $227.24. This was down from $231.54 the previous week and was the lowest the cutout had been since August 21. Cash live cattle are trading roughly $1-2 lower this week. On Thursday 1,620 head traded in Kansas at $102-$103 and an average price of $102.92, down from $104.05 a week before. In Nebraska 2,455 head traded at $102, down from $103-$105 and an average price of $103.71 a week ago. In Texas/Oklahoma 1,816 head traded at $102-$103 and an average price of $102.01, down from $104.76 a week ago.

US beef export sales for the week ending August 27 came in at 11,354 tonnes, down from 11,789 the previous week and the lowest they have been since July 2. The average for the previous four weeks is 14,086. Cumulative sales have reached 690,855 tonnes down from 717,792 last year at this time and 714,935 at this point in 2018. The five-year average is 643,050. The largest buyer this week was Japan at 2,594 tonnes, followed by South Korea at 1,993, China at 1,820 and Taiwan at 1,504. Japan has purchased the most from the US so far for 2020 at 204,158 tonnes, followed by South Korea at 189,777 and Hong Kong at 78,655. China is seventh at 23,978 tonnes. The USDA estimated cattle slaughter came in at 118,000 head yesterday. This brings the total for the week so far to 474,000 head, up from 472,000 last week and up from 352,000 a year ago.