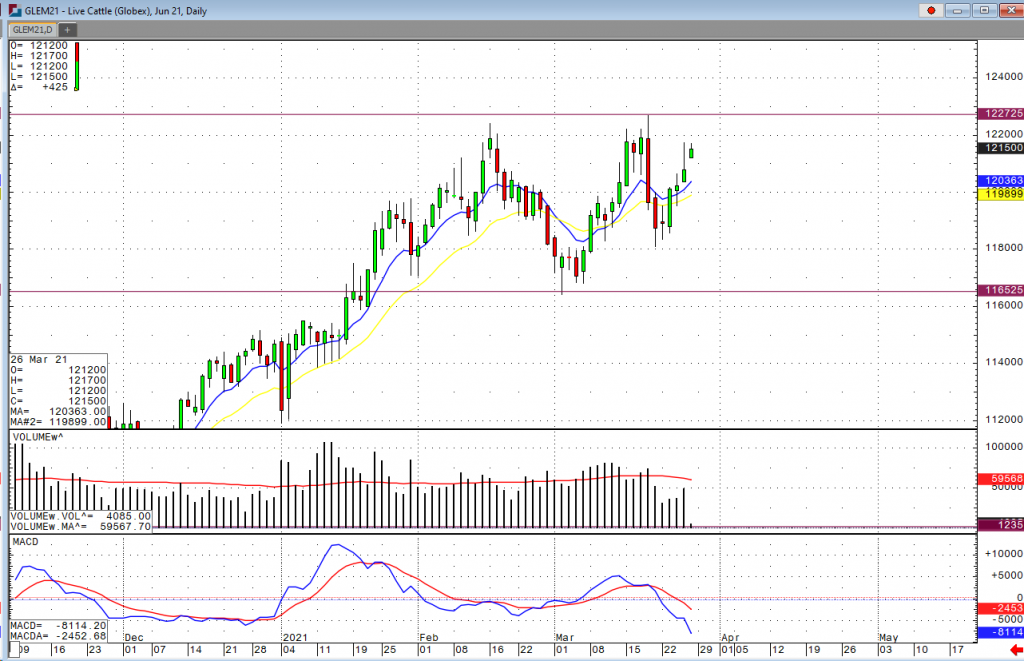

Cash cattle seems to be helping push futures higher, along with the consumer demand starting to pick up as well with the June contract trading at prices we haven’t seen since the march 18th high. The USDA boxed beef cutout was up $1.32 at mid-session yesterday and closed $1.61 higher at $236.45. This was up from $228.61 the previous week and was the highest the cutout had been since March 1. Cash live cattle prices continue to firm. The 5-area weighted average on Thursday was 115.84 up from 114.21 last week. In Kansas, 1,290 head traded at 115-116 with an average of 115.87 up from 113.96 last week. In Nebraska 8,770 head traded at 115-1156 with an average price of 115.96, up from 114.17 last week. Export sales came in yesterday for the week ending March 18 at 18,872 tonnes, down from 25,936 the previous week and the lowest since February 18. The average of the previous four weeks is 19,474. Cumulative sales for 2021 have reached 422,485 tonnes, up from 337,281 last year and the highest on record. The five-year average is 275,823. The largest buyer this week was Japan at 5,828 tonnes, followed by South Korea at 4,440 and China at 3,569. South Korea has the most commitments so far for 2021 at 118,517 tonnes, followed by Japan at 93,983, China at 58,720, and Hong Kong at 47,879. Cattle futures still look to trade higher in the coming days with a near term target for the April contract at $120. June futures I would look tot continue to have more upside potential, but the major pivot point would be around that 122. 75 in the June futures.