June cattle futures finished limit up yesterday which was its highest close since March 11th of this year. There is some good support coming from the discount of the futures to the cash market even as cash continued to rally this week and last. Traders are expecting the slaughter numbers to continue to increase this week while U.S. beef production expected to decline in the 2nd quarter. The USDA boxed beef cutout was up $7.10 at mid-session yesterday and closed $6.81 higher at $475.39. This was up from $428.99 the previous week and was another new all-time high. The cutout has increased for 24 straight sessions. It has increased $253.05 (+114%) since April 8. In their monthly supply/demand report, the USDA lowered 2020 beef production to 25.830 billion pounds, down 6.1% from the April estimate. Poultry production was revised down 2.8% and pork down 5.5%. Second quarter production was lowered by 1.255 billion from the April report, 3rd quarter by 375 million and 4th quarter by 55 million. The USDA estimated cattle slaughter came in at 89,000 head yesterday. This brings the total for the week so far to 175,000 head, up from 155,000 last week, but down from 241,000 a year ago. Cash live cattle were a bit softer on Tuesday. In Kansas, 2,370 head traded at $110, down from $104-$115 and an average price of $110.60 on Friday. In Nebraska, 940 head traded at $105-$110 and an average price of $109.12, down from $114.01 on Monday but up from $108.82 on Friday. In Texas/Oklahoma, 246 traded at $100, steady with Monday but down from $105 on Friday.

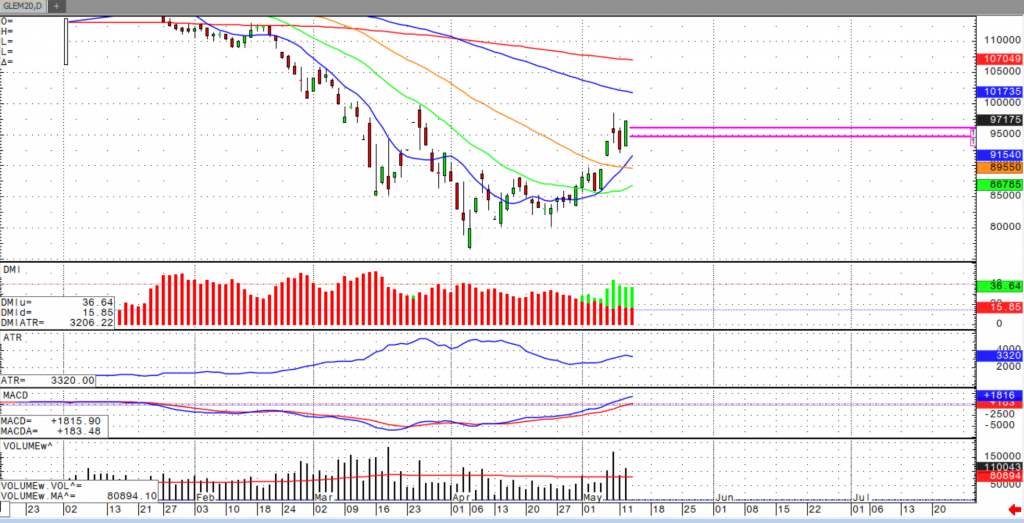

The story of the cattle market is still the supply side news whether it’s about decreased production for the quarter or increased slaughter numbers making packers continue the current pace. The cross over and close above the 60-day moving average is an indication the longer-term trend has turned positive. A positive signal for trend short-term was given on a close over the 9-bar moving average. Market positioning is positive with the close over the 1st swing resistance. The near-term upside objective is at 100.170. The market is becoming somewhat overbought now that the RSI is over 70. The next area of resistance is around 99.170 and 100.170, while 1st support hits today at 95.170 and below there at 92.150.