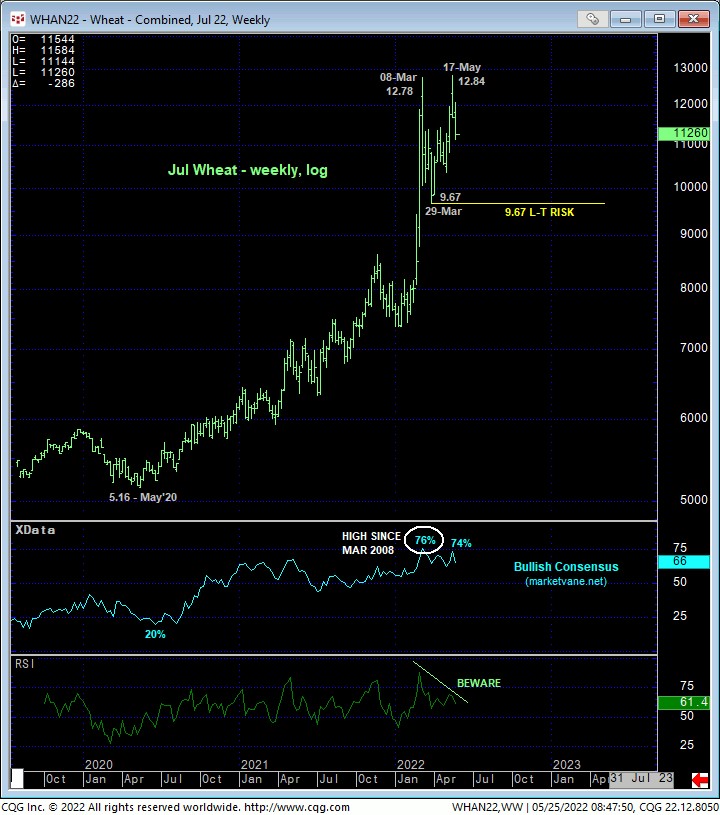

JUL CHI WHEAT

In 18-May’s Technical Blog we discussed that day’s bearish divergence in short-term momentum as being sufficient to identify 17-May’s 12.84 high as one of developing importance but INsufficient to threaten the longer-term bull trend. The hourly chart below shows the ensuing slide that, by breaking below 18-Apr’s 11.43 high and former resistance-turned-support, jeopardizes the impulsive integrity of a longer-term bullish count and exposes a larger-degree correction or possibly a major reversal lower.

As a result of the past couple days’ continued slide, the market has identified yesterday’s 12.06 high as the latest smaller-degree corrective high and certainly 17-May’s 12.84 high as levels this market now is required to recoup to raise the odds of and then confirm the past week’s setback as just 3-wave, slightly larger-degree correction within the secular bull trend. Until a recovery above at least 12.06 unfolds, a more protracted correction or possibly the early stage of a major peak/reversal is expected.

The daily chart above shows today’s break below 18-Apr’s 11.43 high that we previously considered the 1st-Wave of an eventual 5-wave sequence up from 29-Mar’s 9.67 high. This failure below 11.43 negates the impulsive integrity of such a bullish count and warns of a larger-degree correction lower or possibly a major reversal lower. Contributing elements to a broader peak/reversal threat include clearly waning upside momentum on a major weekly basis below amidst historically frothy levels in the Bullish Consensus 9marketvane.net) measure of market sentiment/contrary opinion that haven’t been seen in 12 YEARS.

These issues considered, a bearish policy and exposure remain advised for shorter-term traders with a recovery above 12.06 minimally required to negate this count and warrant its cover. Long-term commercial players have been advised to move to a neutral/sideline policy or even a cautious bearish policy with a recovery above 12.84 required to negate this call and warrant a return to a bullish policy. This includes bear hedges for producers. In lieu of a recovery above at least 12.06, further and possibly protracted losses should not surprise straight away, with 29-Mar’s major corrective low at 9.67 the next key downside threshold, the break of which would break the secular bull market.

DEC CHI WHEAT

From a short-to-intermediate-term perspective, the technical construct of the Dec contract is identical to that detailed above in Jul, with yesterday and today’s continued slide below Fri’s 11.79 low reaffirming the intermediate-term downtrend and defining yesterday’s 12.19 high as the latest smaller-degree corrective high this market is now minimally required to recoup to arrest the decline from 17-May’s 12.82 high and expose it as a 3-wave and thus corrective affair. Per such, this 12.19 level becomes our new short-term risk parameter from which shorter-term traders can objectively base non-bullish decisions like long-covers and bearish punts.

From a longer-term perspective however, the daily log close-only chart below shows the market still above a ton of former resistance-turned-support from the 11.12-to-10.49-range. Against the backdrop of the secular bull market, the past week’s sell-off attempt thus far falls well within the bounds of just another correction. To threaten a longer-term bullish count enough for even longer-term commercial players to move to the sidelines, further weakness below at least the 11.12-area and preferably below 03-May’s 10.52 corrective low close remains required.

These issues considered, a bearish policy remains advised for shorter-term traders with a recovery above 12.19 negating this specific call and warranting its cover. A bullish policy remains advised for longer-term commercial players with a close below 11.12 sufficient to warrant paring or neutralizing exposure. Longer-term players and producers have the option of moving to a cautious bearish/bear hedge policy, acknowledging and accepting whipsaw risk, back above 12.19, in exchange for deeper nominal risk below 11.12 and/or 10.52.

Longer-term players are reminded that the forces behind this market’s most massive bull trend in history aren’t likely to evaporate quickly, but rather over TIME and include a protracted peak/reversal PROCESS. Even after this market confirms a bearish divergence in weekly momentum and exposes the new long-term trend as down, that initial counter-trend decline will likely be prone to a (B- or 2nd-wave) corrective rebuttal that could be extensive in terms of price and time. In other words, we believe there will be plenty of time, weeks if not months, before the long-term risk/reward metrics warrant flipping the script from a massive bullish policy to a bearish one.