A pending decision by Brazil as to whether or not to allow for coffee imports is providing March coffee some solid support lately. Although the Brazilian Chamber of Foreign Trade has not officially made a decision on imports, which is likely to be sometime around February 22nd, the fact that the decision is pending in the first place weighs heavy on the price of coffee. In any case, understandably, Brazilian producers will continue to fight tooth and nail to table the whole coffee import situation for as long as they possibly can. However, one cannot ignore the fact that a discussion of potential imports to the world’s largest producer of coffee only leads traders to believe that domestic supply is tight, and we may see much higher prices in the coming days, until a decision is made. Also, let’s keep in mind that the outlook for the upcoming season’s production is weak, so that too should support higher prices of coffee.

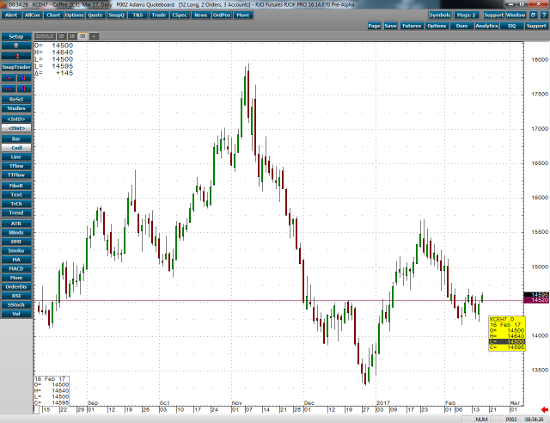

On the daily chart of March coffee below, we can see the 14525 resistance has become new support. Since we broke above this resistance area on January 9th, coffee prices promptly met the November lows, and have subsequently pulled back. March coffee prices seem to be taking a breather, waiting on the upcoming decision. Ultimately, I would advise positioning bullishly.

March’17 Daily Coffee

Source: RJO Futures Pro