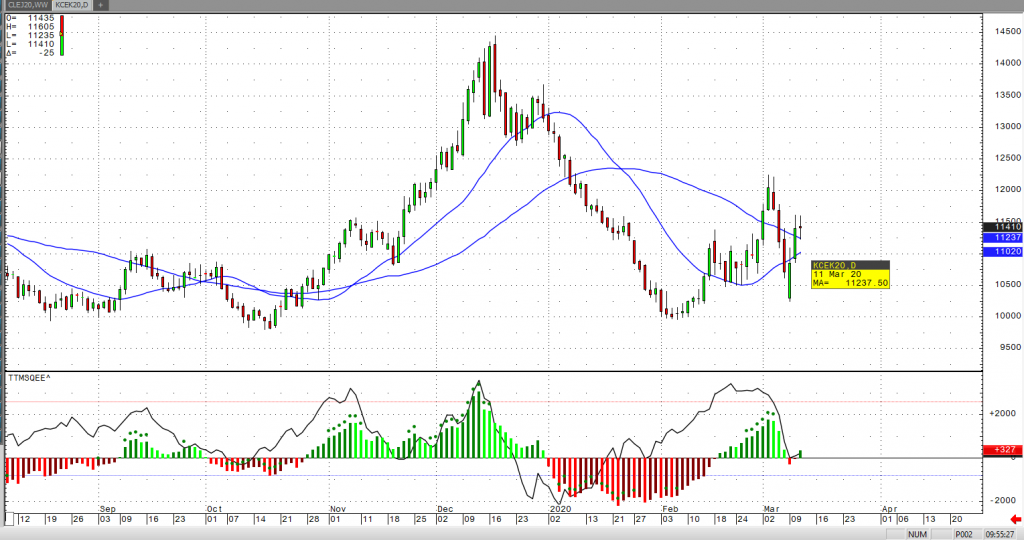

Most commodities markets continue to have massive, volatile swings, and May coffee is no exception. A massive short covering rally pushed May coffee prices high enough to challenge the 115 level, and possibly prompt a continued run back to the 120+ highs we saw earlier this month. The Brazilian currency experienced a boost from a dwindling US Dollar, which helped May coffee prices to find support. In addition, there has been reported wet weather in key growing areas of Brazil that have prompted additional long-term support for coffee prices. Our friends at The Hightower Group have reported that “heavy rainfall over Brazil’s Minas Gerais growing areas could have a negative impact on their upcoming crop if they continue over the next few weeks”.

While the markets continue to display unprecedented volatility as the world struggles to cope with the Coronavirus, commodities will continue to find unstable ground as the underlying fundamentals bear little (if any) impact on the overall price action we continue to witness these days.

From a technical perspective, we have been able to hold support above the 99.55 critical low from February of this year, with a subsequent strong bounce to the 116 level. This price action should be viewed as a potential long-term bottom in May coffee, but with the continued uncertainty related to the Coronavirus, we should expect more sideways price action with massive swings.

Coffee May ’20 Daily Chart