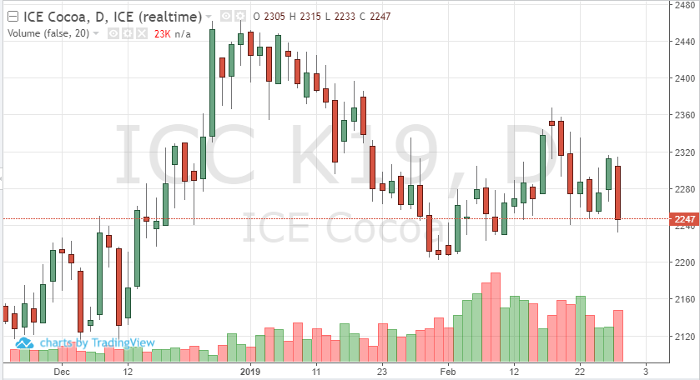

May cocoa futures have had a volatile week as we head into Friday. Bearish supply news earlier in the week out of Ivory Coast caused the market to move lower – but the futures found support from the possibility of a stronger demand outlook. With a weaker euro and pound though, the market wasn’t able to run with the demand news. If the May contract can stay above 2245, look for buyers to re-enter the market. A new trading range appears to have been established between 2240 and 2360. The trendline forming from December 2018 up to today’s close could help the market to recover. That line has been supportive over the past two months. If the May contract can also close above the 9-day moving average, a reversal could occur. The COT data tomorrow will provide some direction for the short-term.

Cocoa May ’19 Daily Chart

If you are interested in learning more on the softs market, please check out our free Trading Softs Futures Guide.