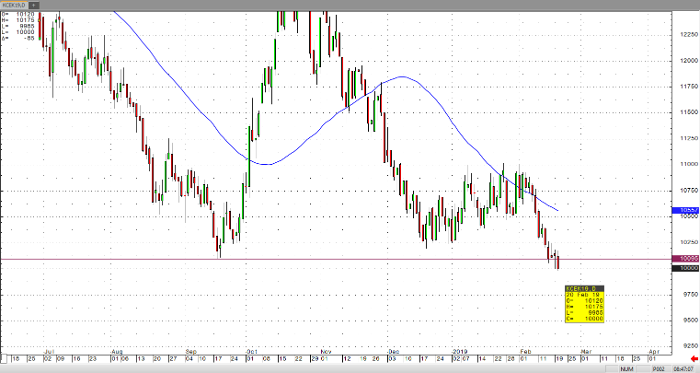

The market is trying to hold the 100 level, but a major violation of support has precipitated further sell-offs in May coffee futures. The main fundamental news is good precipitation in key growing areas of Brazil. Although the Brazilian real continues to hold support levels, this is not enough to prompt a reversal of May coffee prices to the upside. Weak near-term outputs from Brazil will be completely overshadowed by the promise of a large crop to come, based on this wet weather Brazil is experiencing now.

On the technical side, the main area of attention was the 10095 level in May coffee. This area should have acted as strong support but, for the last three out of four trading days, have violated this area. Since we have violated this key support area, I would expect to see some continued aggressive selloffs take place in May coffee before we find any bullish news to hold support. A fairly convincing dive below the 50-day moving average is negative for coffee prices, but we may very likely see a revisit to support at the 102 area before another leg lower.

If you would like to learn more about softs futures, please check out our free Fundamentals of Softs Futures Guide.

Coffee May ’19 Daily chart