It is starting to look like this summer’s rally in gold is coming to an end. Gold was down .45% this morning and has since struggled to find its footing as hedgers have started to liquidate their holdings in gold. According to Kitco.com, gold’s net length is at its lowest point since early July and traders are starting to voice bearish predictions for gold’s future. This bearish outlook has taken some steam out of the gold’s sails and speculators are mixed on where they think the shiny one is headed.

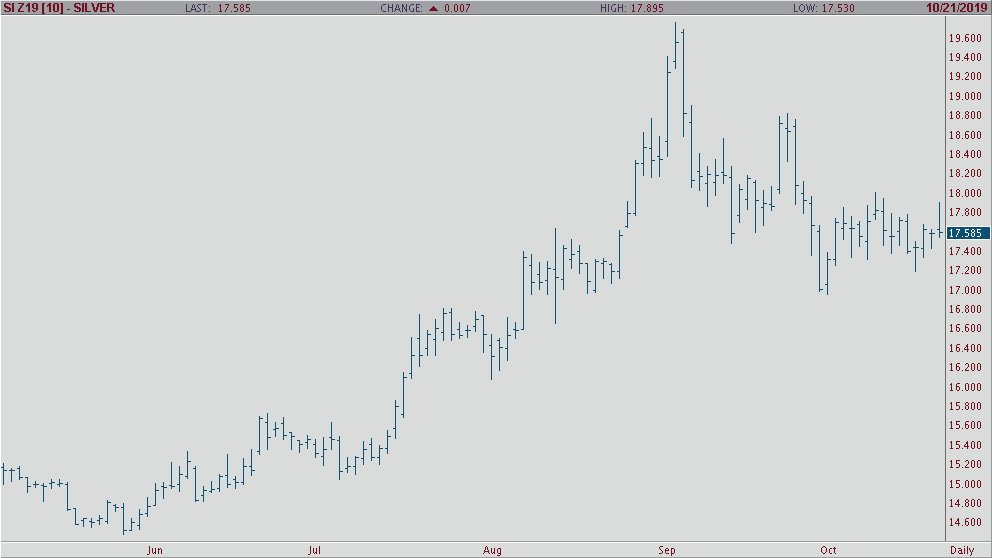

Silver also looks to be following the way of gold as many investors are starting to liquidate their holdings. As of this afternoon, December silver was at $17.57 today, roughly down .02%. However, there looks like there could be a shortage in the short-term future which would drive prices up says Eric Sprott of Sprott Inc.

Sprott went on to say, ““There is going to be a shortage of silver. We get information from dealers looking for supply and paying premiums, which is almost unheard of. And when I look at the amount silver going into ETFs and going into India, there is no way that there is not going to be a shortage,”.

We’ll see where the market is headed, but keep an eye on metals.

Silver Dec ’19 Daily Chart