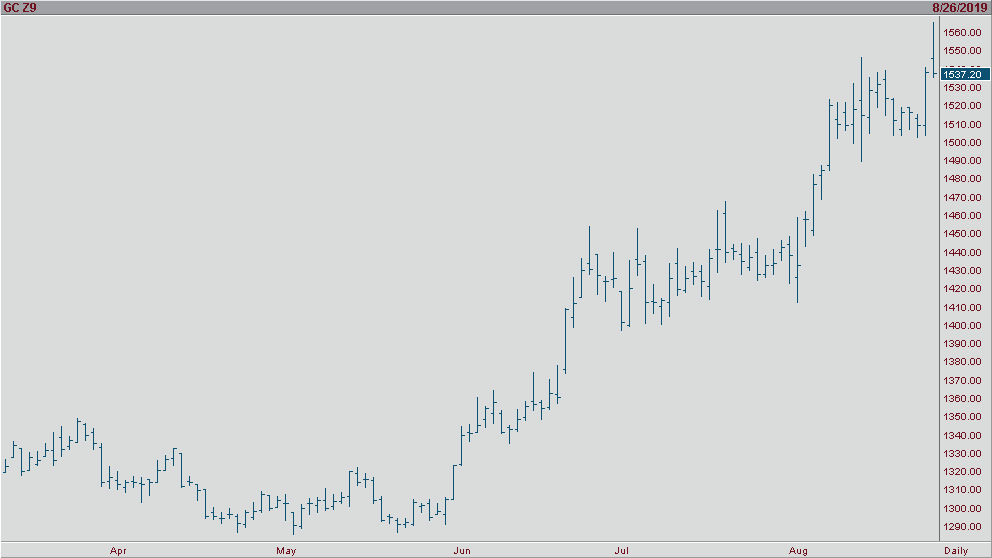

Gold futures are running slightly higher this morning as the we begin today’s trading session, but its counterpart, silver has really taken off hitting a two-year overnight high. The weakness in the USD is likely the driving factor in this latest run for the two metals. As of Tuesday morning, Silver prices were up to $18.075 an ounce, good for a $.295 increase. Meanwhile, gold hit 1,541.90 and ounce which was a $4.60 increase.

Many speculators remain bullish on both gold and silver as they expect the demand for these two safe-haven metals to stay steady amidst the weak U.S. dollar and ongoing issues between President Trump and China. In a quote in Kitco News, FXTM market analyst, Han Tan says, “Markets are finding any excuse to push back into risk-on territory, although such forays may be based on fleeting emotions. Given the persistent nature of the U.S.-China trade conflict, which has injected greater doses of recession fears into the markets, the overall demand for safe-haven assets is expected to remain resolute,”. It seems as the longer the trade issue with China last, the stronger gold becomes.