Corn: Friday’s sharply lower close down to $3.44 after previously trading in the mid $3.60’s earlier that day, was looked at as a bearish technical indicator. That coupled with much needed timely rains across parts of Iowa and N. Illinois, set the market up to gap lower on Sunday nights re-open of the grain markets down to $3.41. Although the gap was minor, there is still a gap on the chart, so be weary of this trying to get filled. Weather continues to improve, and we fully expect Monday’s crop progress to show improvement in the corn market to reflect this better weather. On the flipside, China has remained active buyers of corn, but anyone who follows the market knows China can pull the rug out from under us at any given time, or in other words, decide they are done buying for now. Overall, I would lean towards this market being rangebound for some time now until we get major news from weather or China demand. My suggestion would be to price out a wide range of calls and puts and figure out which ones make sense for your account to be selling and trying to collect premium. Keep in mind that selling premium has substantial risk.

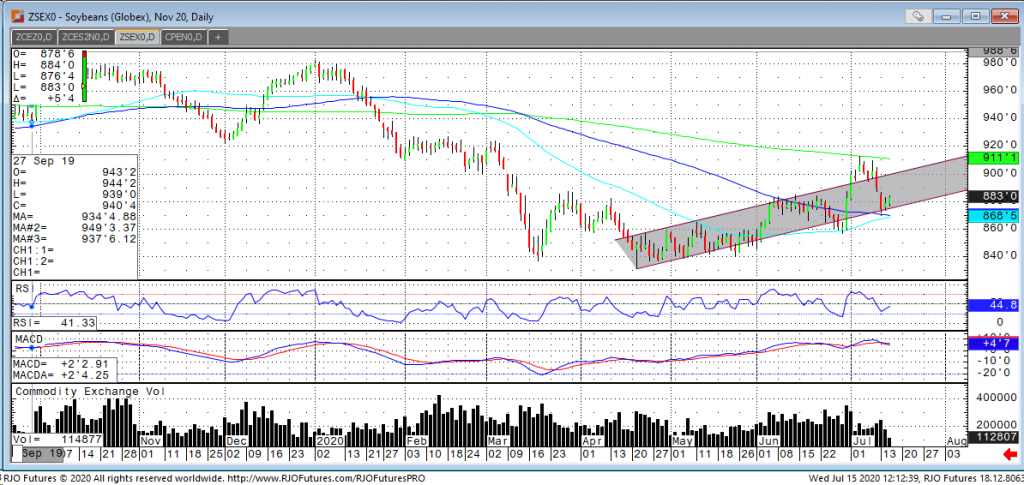

Soybeans: Like corn, soybeans finished sharply lower on Friday which led to a gap lower open on Sunday night. Much needed rains were a large factor for this sell off, as well. With weather outlooks remaining hot and wet, this is a bearish factor for the soybeans over the next 11-15 days. The recent bounce is mainly in part to technically hitting support, as well as being a bit oversold from Friday-Monday sell off. The market gave back $.30 of its gains from June 30th report. For now, I would recommend letting this rally get near the top end of this channel it is in before trying to get short. Whether using options or futures will depend on your personal risk tolerance.

If you’d like to learn more about the agriculture markets, please request our exclusive 2020 Grain Futures Outlook. If you have any further questions or needs, please contact Tony Cholly at 1-800-826-2270 or email him at tcholly@rjofutures.com

Our 2020 Grain Outlook Includes:

– World Corn Outlook – Stock Change vs. Usage Ratio

– U.S. Soybean Export Sales and USDA Forecast

– U.S. Planted Wheat & World Wheat Production

– And Much More!