Global equity markets were mixed overnight with several markets in Asia closed for holiday. However, US equity markets have started the trading session off on a weaker footing which could be the result of a lack of forward progress in Washington on a lengthening list of political footballs. Not surprisingly, many analysts have turned guarded toward the stock market because of the lack of a forward path on tax reform. In fact, instead of a focus on pro-growth, Washington looks content to settle into a battle Royale on a Supreme Court nomination. While the Supreme Court composition is an extremely important issue, the focus on growth and jobs is lost in the smoke of government partisanship.

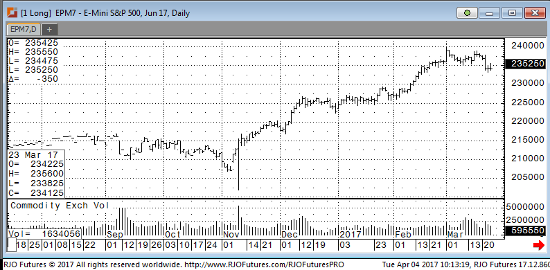

Typically, the stock market does not like uncertainty, and it goes without saying that political uncertainty is expanding rather than contracting. Another issue that appears to be undermining stocks is a growing list of analysts recommending higher cash levels because of geopolitical and economic turmoil. In fact, to limit the slide in the June e-mini S&P today probably requires a better than expected US factory orders result early on. We see little in the way of support until the 2340 level and perhaps not until a series of consolidation closes around 233800.