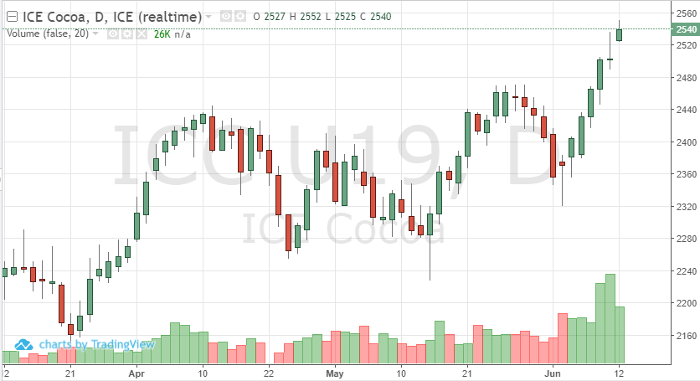

September cocoa continues to move higher. Traders are rolling or reestablishing their positions from July to September in the futures market. Although we are reaching overbought levels, fundamentally and technically, we could see the market move higher. Cocoa has closed higher the past week, making new highs. We haven’t seen these levels since about a year ago. At these levels, traders may consider taking profits and lightening up on long positions. Fundamentally, key areas – mainly North America and Asia, have had a strengthening demand outlook, which is positive for prices to move higher. If demand can hold, this factor mixed with the July to September roll should help the futures contract push towards 2600. If key producers continue to help the bulls on the supply side of the equation, this key level of resistance is realistic in the near-term trade. Although supply and demand are currently supportive for prices to stay at these levels, global uncertainty stemming from the equity markets could cause pullbacks. These pullbacks may create attractive buying opportunities for traders who have staying power. With little support at these points, mixed with an uneasy global tone, traders should remain cautious. Look for the COT report Friday to give some feel for how traders are positioning themselves as well.

Cocoa Sep ’19 Daily Chart