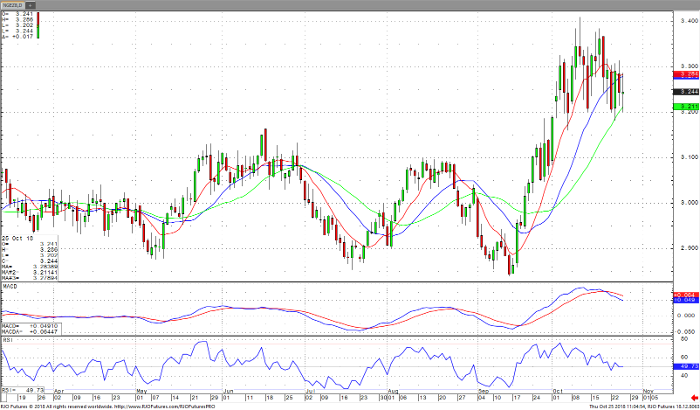

December Natural gas has been trading in a ten cent range between $3.200 and 3.300 for the past week, before that $3.300-3.400 was the norm. I believe that this pattern will continue between now and the first really cold forecast. Moving averages are flattening out and so are momentum indicators. Support comes in around $3.200 and resistance at about $3.300, with that said, closes above and below may move the price into the 10 cent range.

The actual build was lager than expected, 56 bcf v 47 bcf, which should keep the pressure on Dec. natural gas to keep going south. The added pressure of warm temperatures should keep prices in the current range, and I think the price of gas will continue to vacillate in that range. Staying on the sidelines, keeping your powder dry for a bigger move makes sense for now. Any decisions should wait for confirmation by the charts, until then doing nothing is a trading strategy that works while we wait for confirmation of a move in either direction.

Natural Gas Dec ’18 Daily Chart