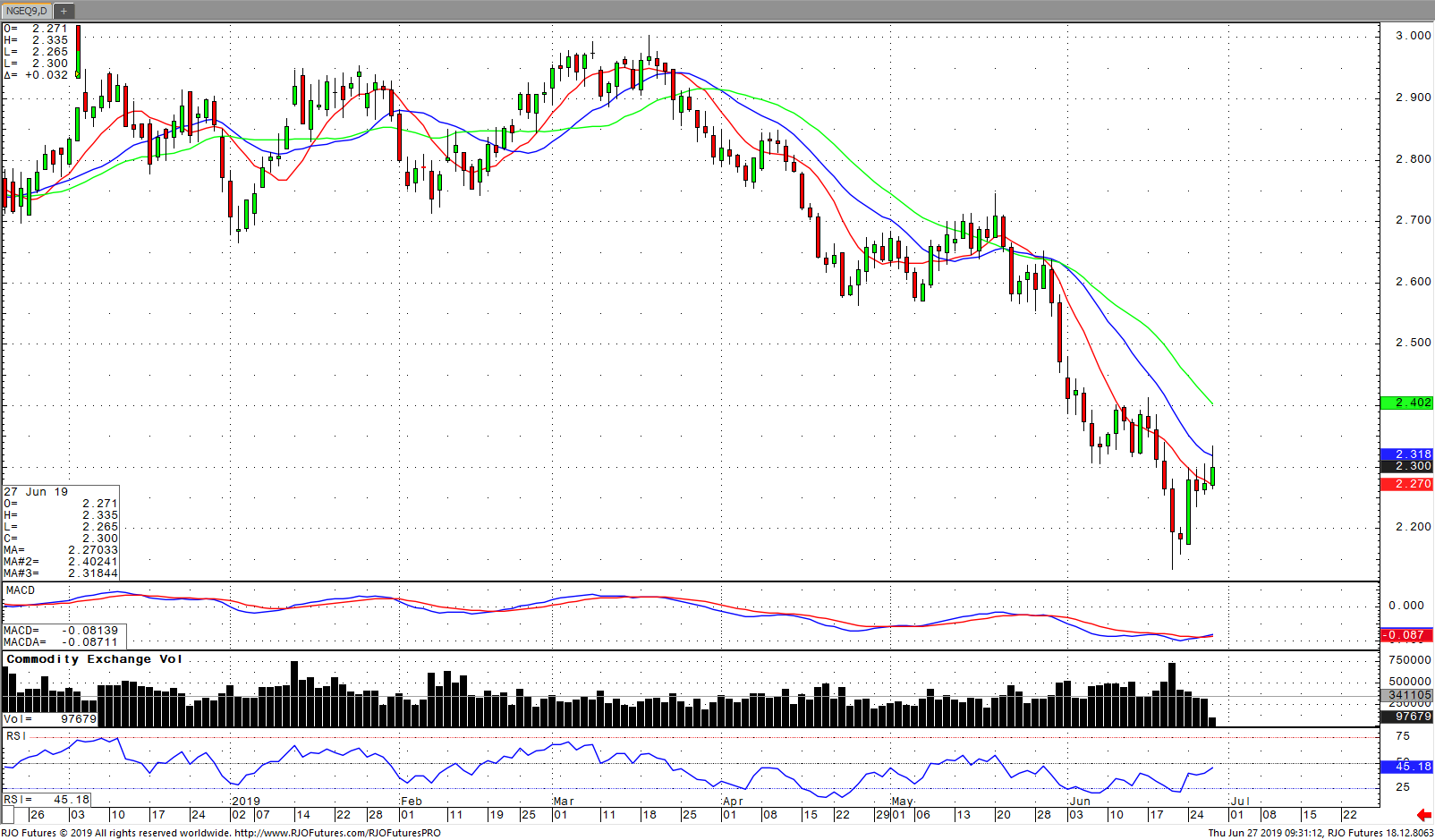

August natural gas is in a technical uptrend, but seems to be capped by the $2.300 handle. Resistance is at $2.300, but further out $2.378 is the level that seems likely. If these levels are broken, is not out of the question for gas to hit $2.600. Gas is cheap now comparatively and might have the buying side come in trying to pick bottoms. Down side risk is around $2.200, but I don’t believe it will go to those levels though. A standard pivot calculator puts support around $2.251 and $2.181.

A cool start to the Summer and an abnormally large amount of precipitation has many people on the short side of the market. Above average temperatures are forecast for the coming week and may change that outlook. I wouldn’t want to go home short over the weekend.

Natural Gas Aug ’19 Daily Chart