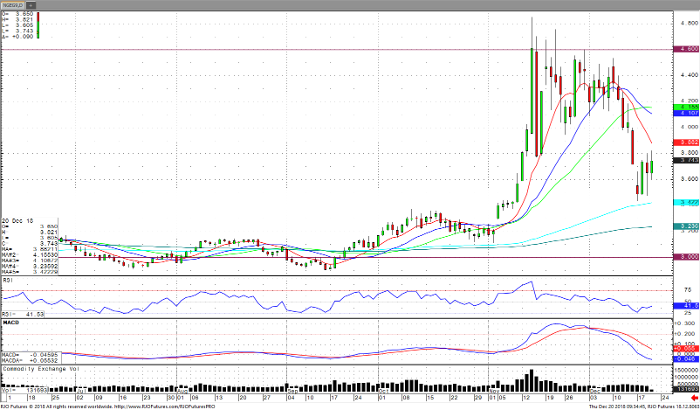

Happy Holidays to all. Natural Gas is in a slight uptrend. After a wild ride the past month, the prices are starting to stabilize and are about half way between $4.600 (resistance) and the $3.000 mark (support). A gap opening early this week has been closed and I believe the prices should try to fill November’s gap at $3.300 before normalizing and following the weather patterns more closely. The price action is between the shorter and long-term averages. Volume is down because of the holidays. Momentum studies are mixed, MACD is pointing down, RSI is at mid-levels and moving sideways.

Weather is still forecast for above normal temperatures for the foreseeable future. Yesterday, gas traded down to a low of $3.475, but was able to recoup about half of the losses on the day. Colder weather will be needed over the coming days for bulls to take control again. Today’s draw is estimated at -136 bcf. On the demand front, a large deal has been inked with Poland over the next 20 years. 15 -20% of Poland’s gas needs could be taken care of by this deal. To discuss February Natural gas, or other trades call 888-874-8110.

Natural Gas Feb ’19 Daily Chart