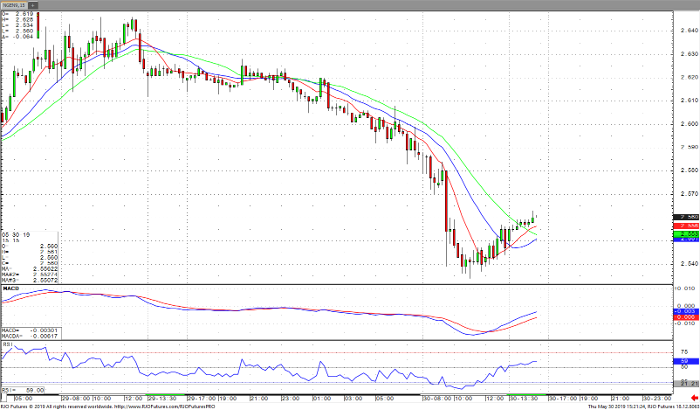

Right now, the trend in natural gas for July is neutral. For the past week gas prices have stayed in a range, with support near the $2.550 mark seems to be a near term bottom. Lower lows and lower highs from yesterday may speed a move to bottom, the low at $2.340 should be the low of the move. MACD and RSI are both around mid-level. A close below the lows can open the gates for a sell-off to uncharted territory. A close above yesterday’s high at $2.650 should turn the tides back to bullish forces.

Today’s bearish storage number (114 bcf actual v 98 bcf expected) moved the market when it was released. The market has been fighting back all day making gains and a new high since 9:45am. Cooling season is right on the horizon, but not yet. The rainiest May that can be remembered isn’t over and the weekend is a mixed bag when it comes to forecasts. Weakness in the energy sector is weighing on the price of gas. Given the weather and other energy prices, the best move may be to be on the sidelines. Wait until a clear pattern is in place. You may leave some money on the table, but you won’t lose your shirt in the process.

Natural Gas Jul ’19 15 Minute Chart