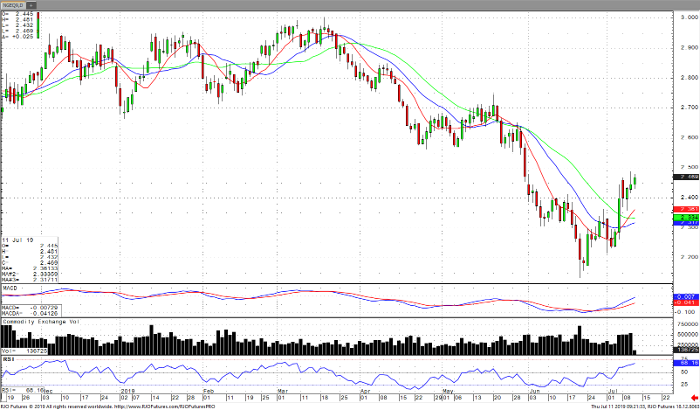

August Natural Gas is above the $2.400 mark, a key point of resistance turned support over the last week. Momentum indicators (RSI and MACD) are both turning up showing that prices may increase on a move to the bullish side. If yesterday’s high is broken, the $2.600 mark is the next level that needs to be penetrated. $2.568 is the first resistance, above that we are looking for a breach of May 20th’s high of $2.745. Support is at $2.400, to change the trend a close below $2.263 is needed to turn the trend negative.

Much of the support in natural gas comes from the weather reports over the coming week. The first storm of the 2019 hurricane season is brewing in the gulf. The storm in the Gulf of Mexico is slow moving and by the time it makes landfall should be classified as a hurricane. The track may be the same as Harvey back in 2017. New Orleans is already experiencing a storm surge and is under water. The city is protected up 20ft, the predicted levels. This will disrupt the supply to the country. Weather is also turning toward normal to slightly above normal temperatures which will increase cooling needs. Over the coming days I would choose the long side.

Natural Gas Aug ’19 Daily Chart