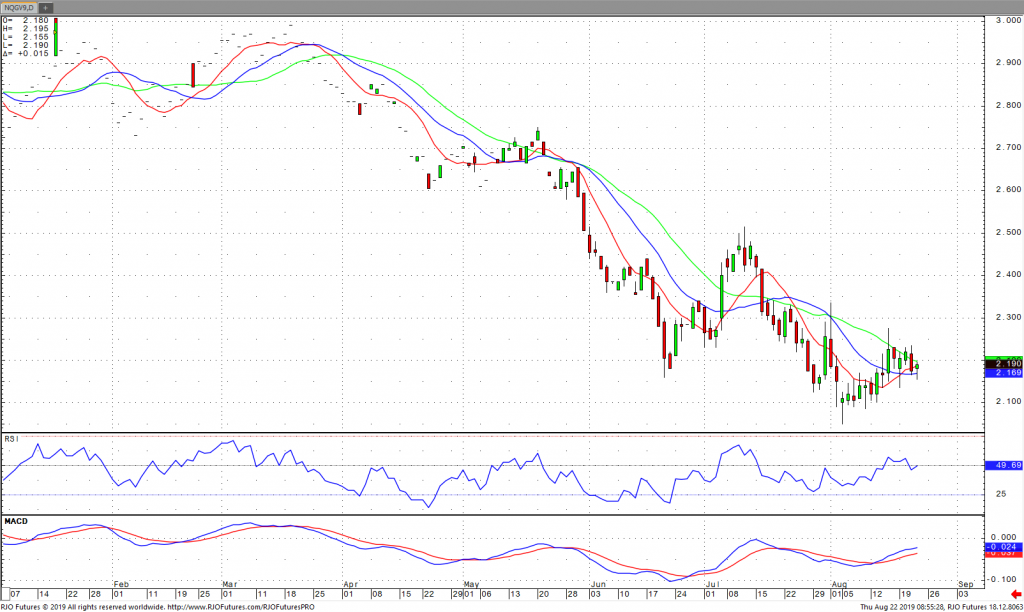

Natural gas for October is trading sideways right now. A slight uptrend had taken place until it flattened out today. If we can break yesterday’s high the uptrend will continue. Today’s pivot number is $2.173 with $2.160 and $2.140 as support numbers below. Overhead resistance looks like $2.190. Above that, $2.203 to $2.263 should be the next trading range higher. Momentum studies seem to be around mid-levels but trending higher. Prices should accelerate in the direction of these indicators. MACD and RSI look to be trending up.

Weather for the upcoming week looks good as cooler temperatures than previous weeks are expected. This may put damper on the bull market. We are getting to the end of the cooling season and the heating season is not yet in effect. Demand can be decreased by an economic slowdown as well. The EIA storage report estimates a build of 57 bcf. If today’s number surprises by being larger, $2.050 may be breached, but the path of least resistance remains up. On the other hand, a smaller number than the forecast will drive the market higher.