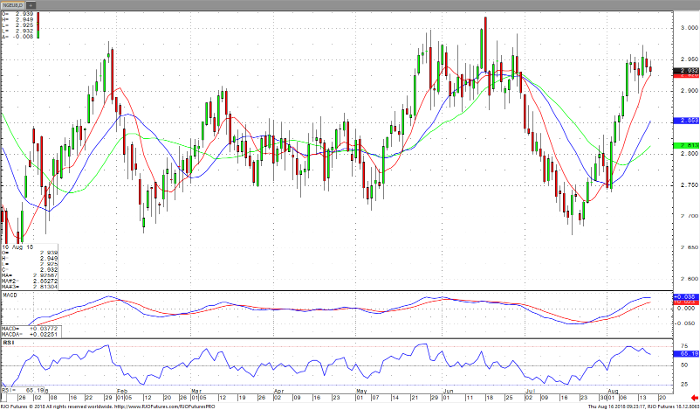

September Natural Gas is trading sideways to a short-term up pattern. It seems trapped in a range between $2.900 -and 3.000. Momentum studies are high and are starting to move downward. The moving averages are trending higher but should start to turn over soon. As the prices reach toward the $3.000 level buying pressure should abate. Support is apparent at $2.900, maybe a little below. There is strong resistance just below $3.000. A close above $2.980 should signal another leg higher, but I personally don’t think so. A close below the $2.900 level may signal a move to the next range lower.

In today’s EIA report we saw a smaller than usual injection of 33 bcf introduced into the supply chain. Moderate temperatures are expected in the coming days of the short to medium-term. Coupled with the low injection this may cause prices to drop if the $3.000 level is approached. I would recommend exposure to the short side of the market. Caution should be used until momentum studies show divergence to the price level.

Natural Gas Sep ’18 Daily Chart