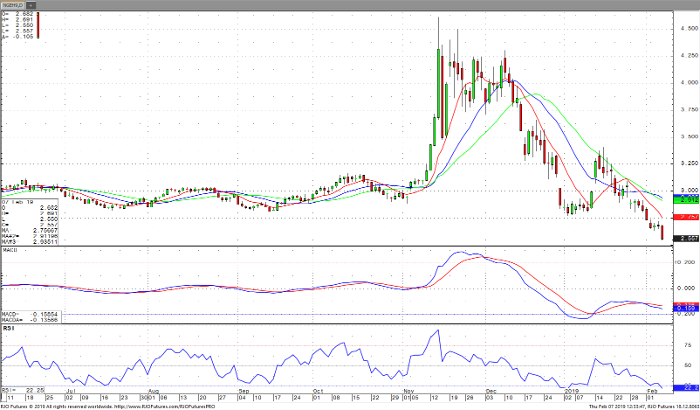

The trend in natural gas is still down over the short-term. March is down nearly .11 cents today, and new lows are being forged out for the March contract today. Momentum studies are oversold, but still trending lower. Prices seem to be trying to go lower to a new range. Divergence is being waited on to make any bullish decisions. Over the short-term we need to stick with the trend. Just above $2.650 is close in resistance on a pivot point calculator. $2.740 and $2.680 show up above that. $2.600 is the pivot and $2.510 and $2.460 show as support.

Temperatures are normalizing and going higher over the coming week. Last week’s deep freeze seems a thing of the past. The storage estimate for today was -248 bcf, and the actual storage was-237 bcf. So, a smaller draw along with a favorable weather forecast sent prices plummeting. I suggest that the price of Natural gas will stay in a range between $2.600 and $2.900.

If you would like to learn more about energy futures, please check out our free Fundamentals of Energy Futures Guide.

Natural Gas Mar ’19 Daily Chart