Late last week natural gas gapped open almost .18 cents per bcf, but since then it has been trading sideways more than anything. The 3.500 handle is well above last month’s trading range and congestion. You may see Natural gas try to close the gap over the next few trading days, but caution should be exercised because of the cold weather that has been forecast over the coming weeks. Support is around 3.440. Momentum studies are still trending higher, but should start to roll over if the current pattern remains intact.

Increased daily production keeps the bull camp in check. Daily and yearly increases in production are keeping a lid on prices. Today’s injection is expected at 56 bcf, which is more than the 5yr average of 48. A move down to fill the gap would not surprise me. The market should continue to move sideways to lower if really cold weather does not move in. It seems this year went from summer to winter, but what will happen when the temperature really gets bad?

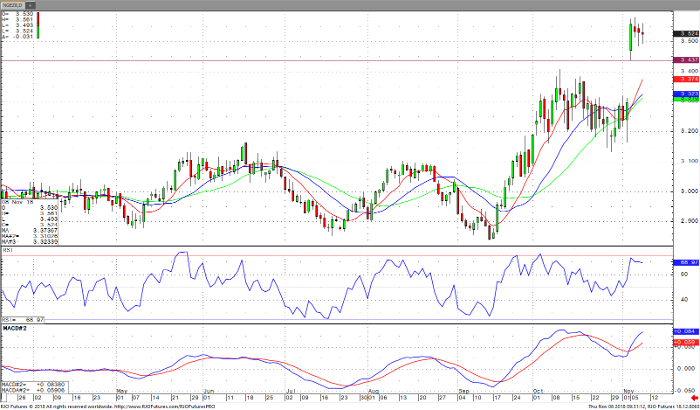

Natural Gas Dec ’18 Daily Chart