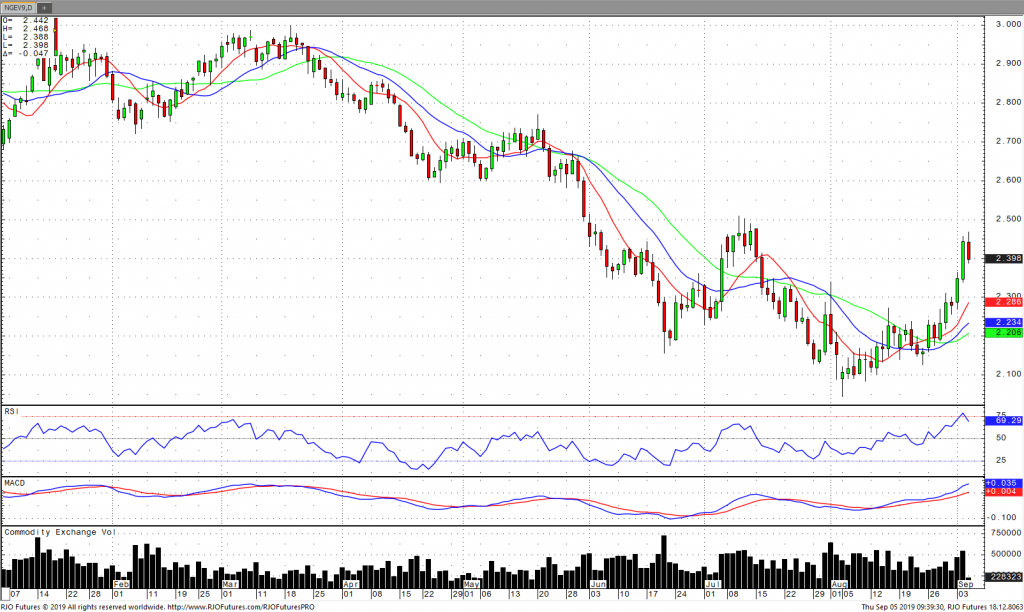

Natural gas for October has been in an uptrend since August 23 and all moving averages are pointing up. Higher highs and higher lows are prevalent in the charting. Today’s pivot is $2.411. Support comes in at $2.353 and $2.331 near yesterday’s low. Resistance is penciled in at $2.468, today’s high. A close above $2.500 could take natural gas to the next higher trading range, but beware the divergence in RSI, it still has not broken too far from the overbought condition, but is beginning a move downward. This may signal a down turn in prices should this continue.

The run up the last few sessions may be due to short covering. Stops have been violated and this may have lead the price to jump. The weather across 2/3 of the continental U.S. is forecast for above average temps, this should support the market a bit. The recent turn North of the hurricane has tempered the upside because most of the storm’s energy is out to sea. We are expecting a fairly large injection into storage with today’s numbers. 77-79 bcf is the amount estimated. Production remains high and the passing of hurricane Dorian to the North won’t affect the supply chain.