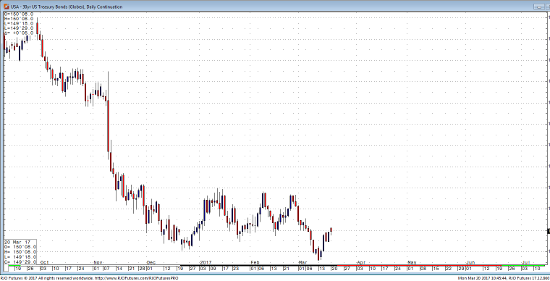

Treasury yields ticked lower on Monday, as the Federal Reserve’s unwillingness to signal a more aggressive pace of interest rate hikes has helped support the battered treasury market. The benchmark interest rate target was raised by a quarter of a percentage point to a range of between 75 basis points and 1%. This was totally baked in, and shorts have been forced to start covering.

This morning, the yield on the 10-year note was working slightly lower at 2.482% .The 30-year yield is now also lower on the day as the Nasdaq has pushed once again into new highs after a slightly lower start. The key point of last week’s meeting was that Central Bank left its projections for the pace of interest rate hikes unchanged over the coming year, disappointing some investors who had expected them to signal that hikes would happen more swiftly. Gold got a big bounce, and the dollar fell a bit. Volatility has also fallen a bit in treasuries as the market moves away from previous lows, holding the test at previous support. This has been surprising to some participants who were positioned for a downside breakout. The biggest news for the upcoming week will be a possible vote on a new health bill on Thursday. A number of fed members have scheduled speeches as the quiet period around last weeks meeting is now over, but it’s hard to imagine any of them saying anything interesting enough to rock the boat . Durable goods updates on Friday will probably be the biggest economic release. Expect coupon prices to test higher (yields lower) as the week progresses.