U.S. stock futures took a tumble this morning after President Trump tweeted he wanted to shut down immigration into the U.S. in the wake of the current coronavirus pandemic. This sent the market open into a tailspin as the Dow dove 2.7% preopen, followed by the S&P 500 losing 2.2% and the Nasdaq losing 1.3% too. It seems Trump’s tweet was the leading factor in this loss as the markets had previously been trending higher.

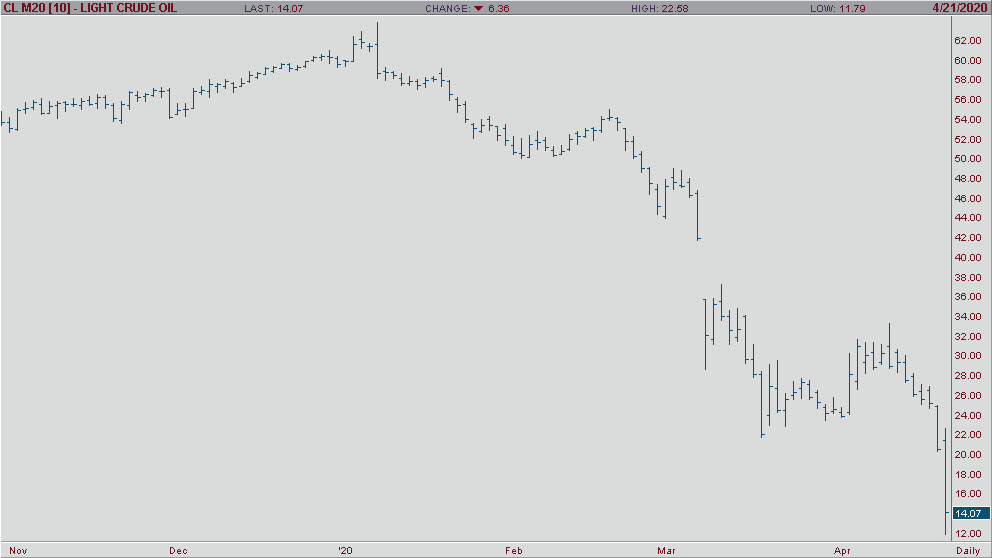

Oil has not fared much better today after yesterday’s disaster. At one-point June WTI U.S. oil was down 41% to $11.79 a barrel before finally leveling out at $16 a barrel, good for a 21% loss. Meanwhile Brent crude oil dove 30% down to $18.19 a barrel before finding its level at $21 a barrel. Unsurprisingly, Chevron and Exxon Mobil stocks did not fare well because of this, both selling off and falling about 4%. The new issue facing oil is storage. Oil production has continued, and consumption has taken a nose dive, leaving producers with a surplus of oil and no place to store it. It’s hard to figure out a solution to this issue because there is no way to manufacture use of oil out of thin air. We’ll just have to keep a close eye on the situation and see how it develops.