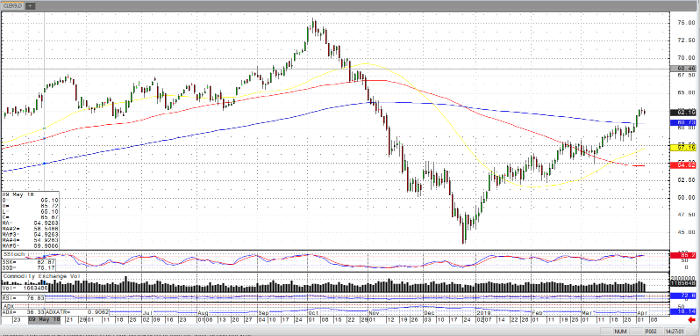

As of Thursday, the front month May crude oil contract is trading 33 cents lower and somewhat flatly compared to most of the daily ranges pictured in the chart below. This is not surprising considering the upcoming employment situation aka jobs number tomorrow, following last month’s tepid, potentially precarious number of 20,000 non-farm payrolls. However, the market shook off the surprise build in the EIA number Wednesday, which had a build of 7.2 million barrels in contrast to expectations of a slight draw. In addition to tomorrow’s jobs number, markets may also factor in the status of U.S. Chinese Trade developments, OPEC and OPEC+ compliance, and the commitments of traders as there continue to be

Technically, the market is now trading at the year’s highs and above the 50, 100, and 200-day moving averages. While there is the possibility of mean reversion and back and fill to the down side, the market is also trading at a level not traded at since last August 15th. While further downside price action could create an island reversal, the previous two days trading has yet to trade outside of Tuesday’s low.

Crude Oil May ’19 Daily Chart

\

If you would like to learn more about energy futures, please check out our free Fundamental of Energy Futures Guide.