Oil futures fell Monday on concerns about major oil producers’ wavering commitment to output caps as a meeting of the Organization of the Petroleum Exporting Countries gets underway. The two-day gathering in Abu Dhabi, United Arab Emirates, will focus on members’ compliance level to the output pact the cartel signed with 10 other oil suppliers, including Russia, in late 2016. The deal so far hasn’t produced meaningful effect in tamping down global output or inventories.

Oil prices are getting weighted down by, concern regarding the OPEC cuts. Looking at past meeting results we should anticipate OPEC cutting in the near future verse adding. The prices had settled higher on Friday, from a solid U.S. employment report and the Baker Hughes’ weekly rig count coming in with a net decline in the past week of one in active U.S. oil-drilling rigs.

One major development we will be watching for out of the OPEC meeting is whether Libya will join the agreement to cap output. The African supplier, along with Nigeria, were exempted from the initial deal because their output were marred by month’s long militant attacks. However, as both nations are now pumping closer to their peak levels, there is a growing view that they should also abide by production caps.

According to S&P Global Platts, the combined July output of both African producers was 590,000 barrels above October’s, a baseline that deal participants used to determine their production caps. The OPEC’s own official monthly report will be published on Thursday.

Traders should expect a lighter market trend until the weekly energy report comes out this week. I think we will get an excellent opportunity to purchase crude over the next few days. The market should trade higher into the next few weeks.

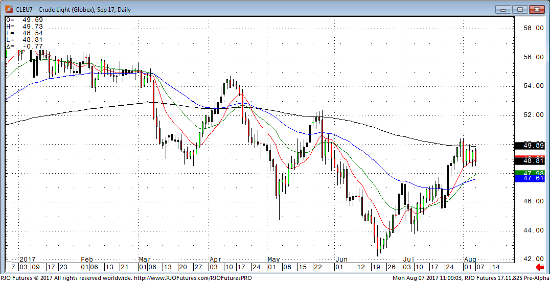

Sep ’17 Crude Light Daily Chart