The oil market this week has been largely affected by the forecast for Florence as the market was strong with anticipation for a category 4 hurricane which could affect pipelines and supply and demand. The weekly EIA report Wednesday morning also showed a draw of 5.3 million barrels.

While anticipation of a category 5 hurricane coincided with the high of the week in the October contract Wednesday morning, since the storm is now a category 2 the market is down $1.75 as of Wednesday morning and making new lows of this writing at 9:30 AM central time.

This week’s price action and market participation offer a lesson in market reaction to weather concerns, as the fear and greed correlated with weather as well as supply and demand concerns may be overdone and subject to change with a changing forecast.

Also, for spread traders, moves between Brent and WTI as well as calendar spreads among different expirations offer a number of market relationships to monitor.

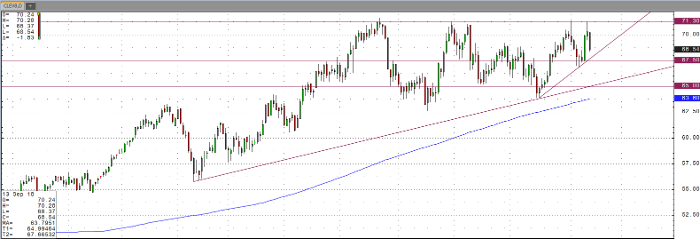

As noted previously, the market seems to sustain its uptrend while testing overheard resistance around the $71.30 level while channeling amid this level and trendline support. Supply concerns from Iran sanctions and Venezuela are typically countered with record U.S. output and announcements from Russia, Saudi Arabia and other oil producing nations to counter any lost production.

Oil Oct ’18 Daily Chart