Crude oil inventories rose by nearly 8.7 million barrels along with along with gasoline and distillate stocks, according to API data. EIA numbers will be watched for any unanticipated build ups. It should also be noted that with crude trading above $30.00, U.S. producers should be at or past break even now. Traders will be watching if this will motivate producers to supply more to the market in the coming weeks, along with the early June OPEC+ meeting. The last joint production cut by the group was done in response to the demand decimation caused by the pandemic, now that global cities have begun re-opening it will be closely watched to see if they will continue down the path of voluntary cuts. It should also be noted that although for the most part API and EIA data may be priced in to the crude options market, the OPEC+ meeting is causing higher implied volatility in the June and July contracts. This expansion is usually related to the underlying asset and uncertainty related to the asset.

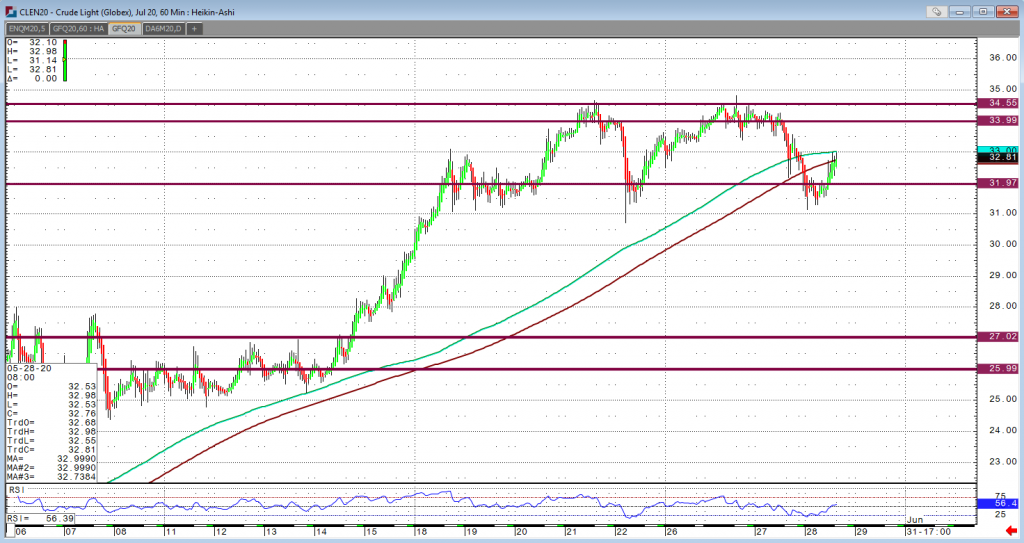

July crude had a short-term bearish signal as momentum indicators started trending lower, the contract has support at $32.50. This level will need to hold but if sellers step in we can see a move lower to test the $32.00 dollar level. Traders will need to watch the $33.00 dollar level as this resistance will need to be broke, in order to see a leg higher to the $34.00 level. These price objectives will serve as a benchmark while we wait for data from a fundamentals stand point to support price levels.