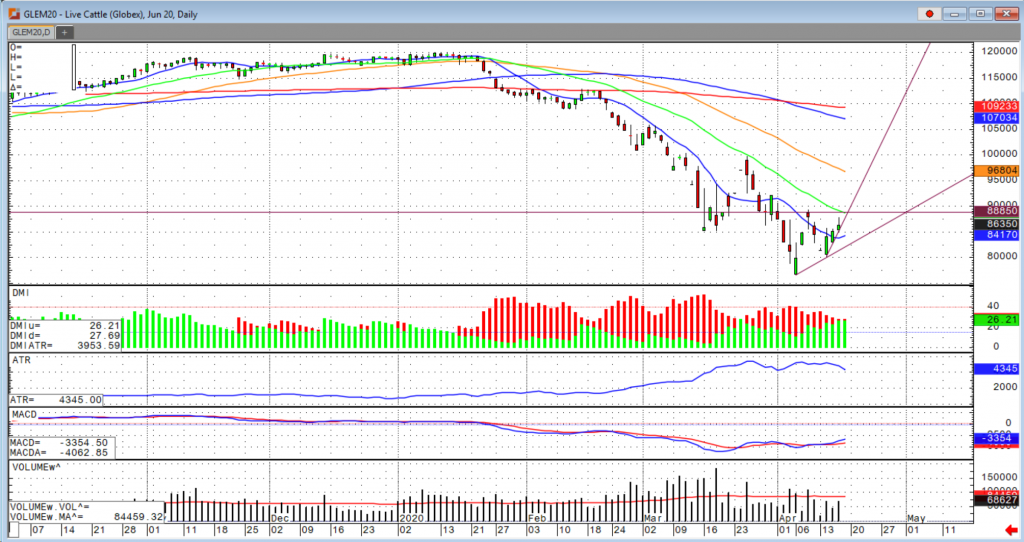

We could start seeing a turnaround in the cattle markets in the short term due to some positive fundamental news with the talks of reopening the economy. Albeit “phased and deliberate”, it’s an opening nonetheless. With the strong week in the cattle market and favorable export numbers showing more active buying from Hong Kong and China, packers now have an incentive to keep feedlots current with marketing’s. There is still a large discount of the futures to the cash market right now with light volume traded this week, with a total of 792 head trading in Iowa/Minnesota at 95-100 over the past three sessions, down from 105 last week and 261 head trading in Nebraska on Wednesday at 94, down from 105 last week.

Yesterday, June cattle hit limit up but closed midrange. This buying interest seems to be because of the big discount of futures to cash but also people could be buying into the thought of restaurants opening up in the coming weeks. One key factor for the producers to keep an eye on is the cash level basis, and although they are still near record highs, the move to a more normal basis could be cause for concern over the next couple weeks that may give the market underlying swings.

The USDA estimated cattle slaughter came in at 92,000 head yesterday. This brings the total for the week so far to 376,000 head, down from 417,000 last week and down from 488,000 a year ago. Average dressed steer weights for the week ending April 4 came in at 889 pounds, down from 891 the previous week but up from 865 a year ago. The 5-year average weekly weight for that week is 868.4.