As expected the Fed announced interest would remain unchanged at today’s FOMC meeting. They gave an upbeat economic assessment, stating that the US economy is ‘strong’. Traders anticipate the Fed will make two more hikes this year, with one coming next month. According to Bloomberg, there is a 92% chance that the Fed Funds rate will be hiked in September.

There have been seven rate hikes since the financial crisis, and the FOMC statement notes that the Fed still plans to continue raising interest rates gradually. Jerome Powell had stated last month that the job market would remain strong, and inflation contained around 2% with the proper monetary policy. In today’s statement the FOMC says “On a 12-month basis, both overall inflation and inflation for items other than food and energy remain near 2 percent. Indicators of longer-term inflation expectations are little changed, on balance.” Furthermore, they stated that “gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective over the medium term.”

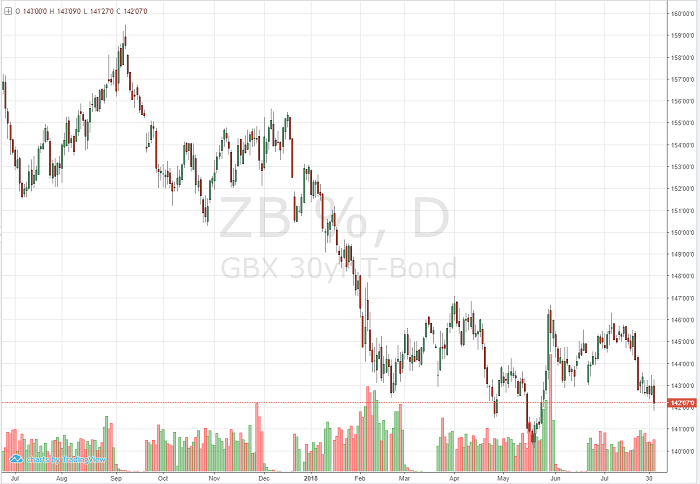

Since my last article, 30yr bond prices have been steadily falling, while yields have been rising. The price runs inverse to the yields. It was noted in the last article that 30yr bond futures were near the top of the range, and it made sense continue trading in the range as long as it held. If traders got some short exposure when the last article was written, near the top of the range, well done, you are looking at a winner with barely any heat. If no action was taken, it still makes sense to continue trading the range. At this moment the Sep 30yr bond futures are trading 142’08, well off the high of the range, and actually in the lower half. Thus, it is a crapshoot, and I would stand pat until we are back in the upper third, or lower third to take a position. Feel free to check in for new levels of support and resistance, and trades we are looking at.

T-Bond Daily Chart