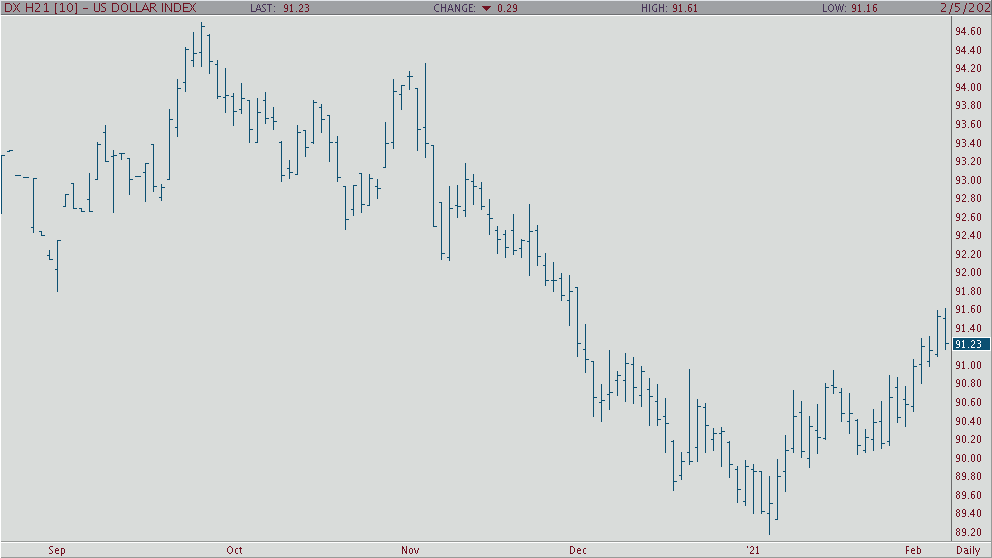

Today will be a very important day for the bull camp in the USD, as the trade is likely to get some type of confirmation on the real focus of the bull camp. Basically, seeing further USD gains in the wake of slightly better US nonfarm payrolls will likely enforce the idea that capital is flowing to the USD off prospects of improved US differential yield potentials. On the other hand, it is also possible that the USD will continue to rally in the face of a disappointing jobs number, which in turn would suggest the bull camp is capable of shifting a number of fundamental outcomes in its favor. USD reaching overbought levels warrant some caution for bulls. A positive sign for trend short term, was given on a close over the 9 day MA. The next upside objective is 9193. Resistance comes in at 9175 and 9190 with support hitting at 9125 and 9095.