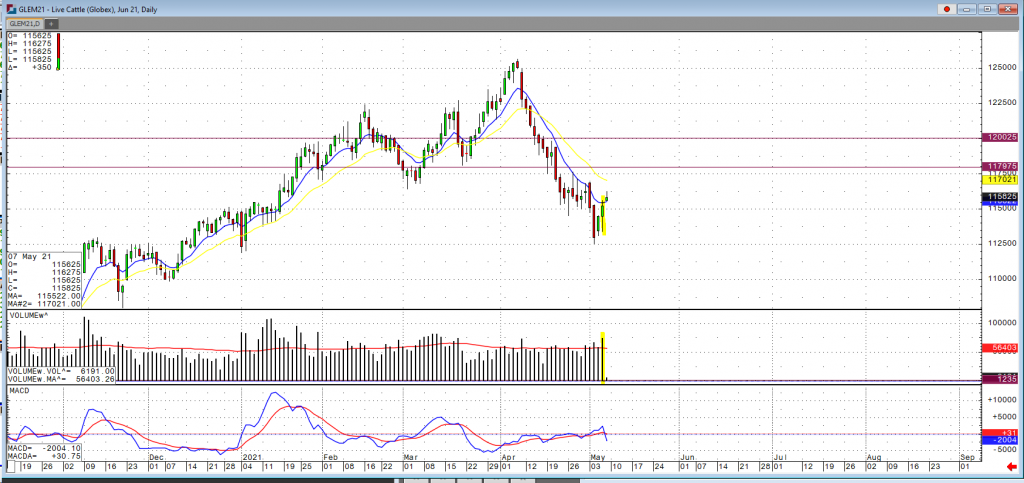

Jun cattle had a strong day yesterday with a sharp recovery

and substantial volume, which may be giving us the indication the bottom is in

and a reversal may be coming in June cattle. Expensive feed costs are also

making traders leery that there may be a short-term bulge in the market which

could eventually have this market make another move lower. The USDA boxed beef

cutout closed $1.59 higher at $306.37. This was up from $293.76 the previous

week and was the highest the cutout had been since June 2, 2020. The 5-day,

5-area weighted average price on Thursday was 118.29, down from 119.01 last

week. This was dominated by a large trade of 12,000 head in Nebraska at 117-118

on Tuesday. Kansas and Texas/Oklahoma traded in a range of 118-119 on Wednesday

and Thursday, with a total volume of 7,915 for the two regions.

The USDA estimated cattle slaughter came in at 115,000 head yesterday. This

brings the total for the week so far to 470,000 head, down from 477,000 last

week but up from 340,000 a year ago. US beef export sales for the week ending

April 29 came in at 16,928 tonnes for 2021 delivery and 161 for 2022 for a

total of 17,089. This was down from 23,572 the previous week and was the lowest

since April 8.

I anticipate the cattle market making a move higher in the short-term on the June contract. Seasonally we are coming into high demand and coupled with strong export number I would put a target at about $118-$120 level before we start seeing some resistance getting hit.