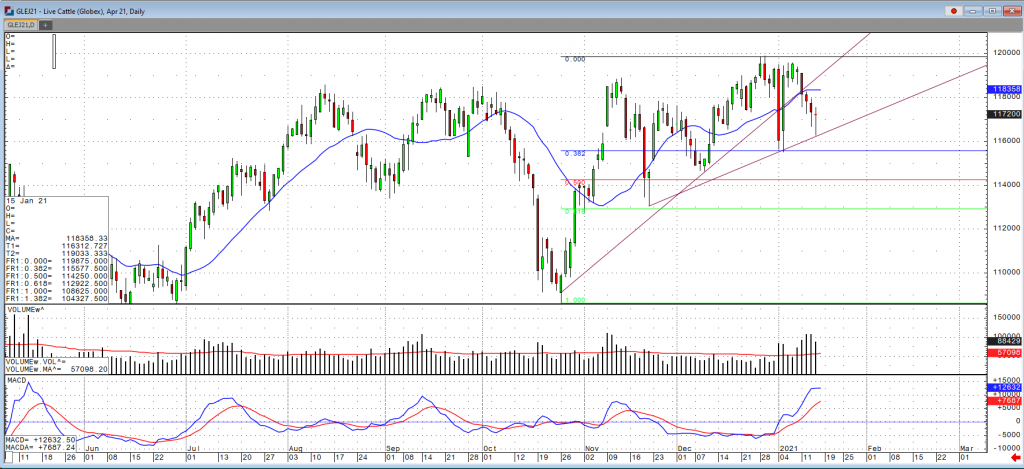

Cash cattle has been trading within the 107-110 range this entire week and continued to trend lower as there have been some trades in Kansas reported at $108. There still seems to be some doubts that short-term demand just won’t be there along with the increased weights seems to be putting negative pressure in the market. With those factors accounted for we have seen a jump in beef prices to the highest levels since December 11th, a shift towards the harsher weather in the plains for the second half of January could cause the market to have some support. The USDA boxed beef cutout was up $2.49 at mid-session yesterday and closed $2.37 higher at $213.37. This was up from $205.81 the previous week and was the highest the cutout had been since December 11. Cash live cattle continued their drift lower on Wednesday, but reported volume was light as of the afternoon. Average dressed steer weights for the week ending January 2 came in at 920 pounds, up from 913 pounds the previous week and 912 a year ago. The 5-year average weekly weight for that week is 902.6. US beef export sales for the week ending January 7 came in at 16,835 tonnes, up from 7,775 the previous week and slightly above the four-week average at 16,254. Cumulative sales for 2021 have reached 202,243 tonnes versus 148,762 last year at this time and a five-year average of 107,783. With the current short-term weather forecast and a solid recovery on the close for the April Cattle off what looks to be the 117 support level, the market looks to retest the recent highs of late December around $120.