Stock futures are trading sharply lower this morning continuing yesterday’s trend. Key economic news this morning was the factor. Personal income rose 0.3% against the expected 0.5% rise. The personal consumption expenditure, the Federal Reserve’s primary inflation measure, rose 0.4% vs. November and 5.8% year over year. Thursday’s losses in the major stock indexes held above Monday’s low which gave hope for week ending rally before the Fed numbers. Earlier this week Jerome Powell, Federal Reserve Chairman, strongly signaled a March increase on interest rates from their near-zero levels. The uncertainty of how quickly they will raise rates and how rapidly they will begin drawing down it’s $9 trillion balance sheet and tightening financial conditions left investors skittish. “Everything the Fed is doing at this point we think has just been priced in over the last few weeks. And that’s where a lot of the slide in the market has come from,” Morgan Stanley Managing Director Kathy Entwistle told Yahoo Finance Live on Thursday. “And the big question is, will we slide a little bit more? What’s happening? We’re looking at companies and their earnings … to determine whether or not we’re going to have a little bit more of a pullback in the market or not,” she added. “And that’s based on what they can do going forward, where their opportunities are. And we’ve been hearing a lot about inflation. If you think about a 7% inflation rate, that’s quite significant.”

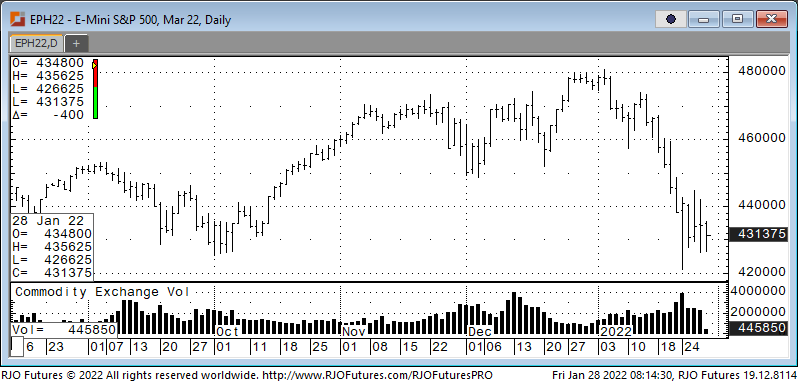

Support today is checking in at 424200 and 417500 with resistance showing 440300 and 44920.