In 12-May’s Technical Webcast following the previous day’s bullish divergence in short-term momentum, we discussed the developing quality-flight from equities to Treasuries given gold’s abysmal performance thus far as a safe haven and with Treasury rates apparently rising high enough to entice investors looking for some place or any place to park funds. As a result of yesterday and overnight’s rebound detailed in the 240-min chart below, the market as identified yesterday’s 118.16 low as the end of a 3-wave and thus corrective sell-off attempt from last week’s 120.005 high that now warns of a resumption of early-May’s uptrend from 09-May’s 117.085 low to that 120.005 high that preceded it. This recovery leaves market-defined lows in its wake at 118.16 and especially 117.085 that reinforce what we suspect is an interim larger-degree correction higher within the still-arguable secular bear trend. Per such, these levels- 118.16 and 117.085- serves as our new mini and short-term risk parameters from which traders can objectively rebase and manage interim non-bearish decisions like short-covers and cautious bullish punts.

Stepping back, a recovery above last week’s 120.005 high will render that high an initial counter-trend high and CONFIRM a bullish divergence in DAILY momentum. We believe this will break the downtrend from at least 07-Mar’s 129.04 high and possibly complete a broader 5-wave Elliott sequence down from 20-Dec’s 131.19 high as labeled in the daily chart above and expose a larger-degree (suspected 4th-Wave) correction higher. Given the magnitude of the secular bear trend shown in the weekly chart below and as recently discussed, commensurately larger-degree strength above at least former 125.175-area former support-turned-resistance is minimally required to threaten the secular bear market. But what the market has in store for even an interim correction between 120.005 and 125.175 is anyone’s guess. Per such, even longer-term institutional players may want to pare or neutralize bearish exposure on a recovery above 120.005 and acknowledge and accept whipsaw risk, back below 117.085, in exchange for much steeper nominal risk to 125.175. This allows these traders to wait for and require a correction-stemming bearish divergence in momentum to reject/define a more reliable corrective high from which to then rebase a resumed bearish policy.

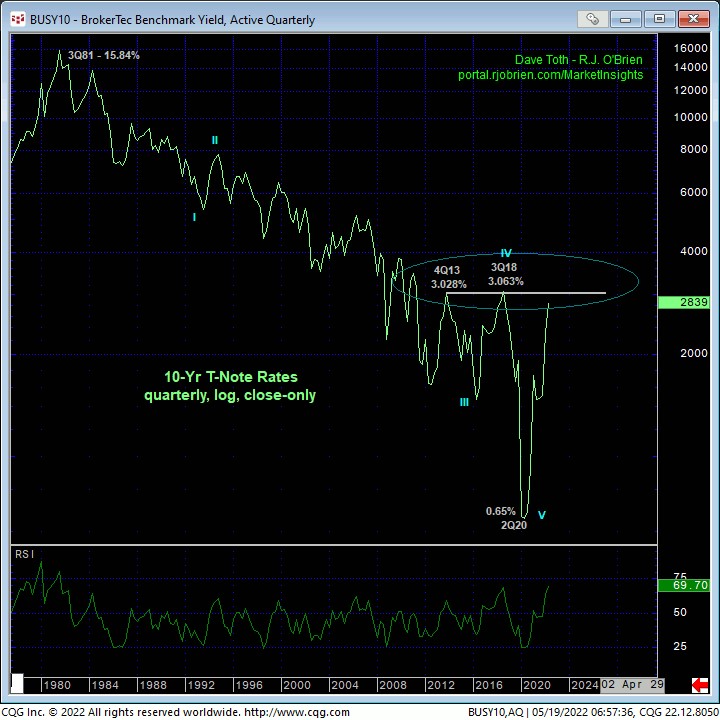

From a 10-yr rate perspective, we recently discussed what we believe to be a long-term resistant hurdle around the 3.00%-to-3.25%-area. The quarterly log close-only chart below shows this area clearly as massive resistance that dates from the 4Q2013. We have made the case for a massive reversal in rates from the 39-yr downtrend to a new generational move higher. We suspect an eventual breakout above this 3.00%-to-3.25% threshold. But the developing bullish divergence in the contract on a daily basis correlates with a bearish divergence in daily rate momentum that identifies last week’s 3.203% high as one of developing importance ahead of a suspected corrective relapse.

These issues considered, a neutral-to-cautiously-bullish policy remains advised for shorter-term traders with a failure below 118.16 required to defer or threaten this call enough to warrant its cover. A relapse below 117.085 is required to reinstate the secular bear. And while it is fully acknowledged that the past week-and-a-half’s recovery attempt is grossly insufficient to be considered as anything more than a slightly larger-degree and interim correction within the still-unfolding secular bear trend, even longer-term institutional players are advised to pare or neutralize bearish exposure on a recovery above 120.005 in order the circumvent the heights unknown of this suspected correction. Longer-term bearish exposure will be able to be re-established following a recovery-stemming bearish divergence in momentum needed to identify the prospective end or upper boundary of the correction from which a resumed bearish policy can then be more objectively rebased with preferred risk/reward conditions.