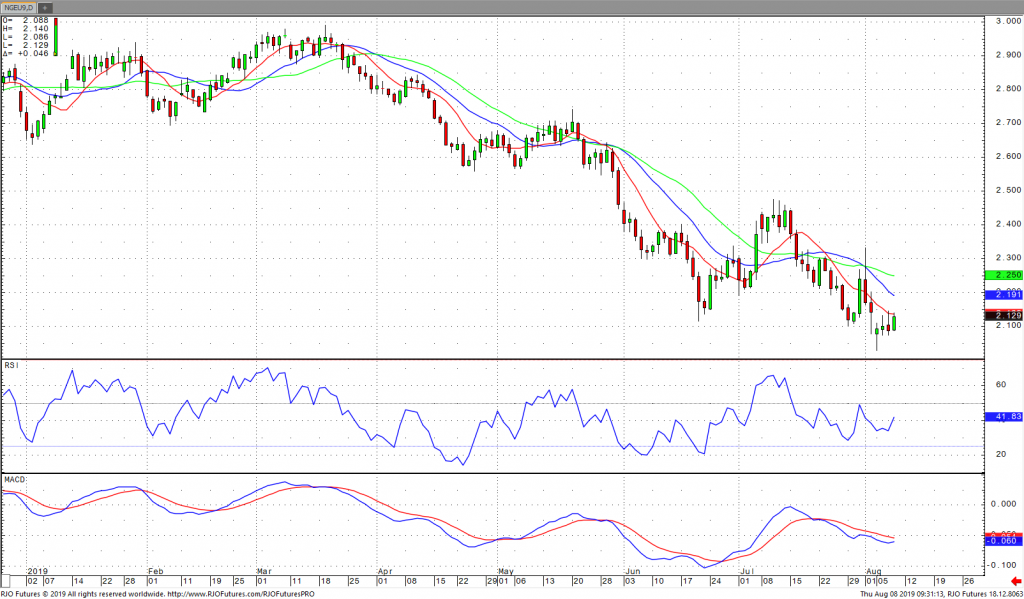

Natural gas for September seems to be consolidating near the $2.100 handle. The market doesn’t seem to have any direction. RSI and MACD are near the half-way level, lending no indication to direction through past price data. Today’s pivot numbers are in a narrow range with $2.110 being the pivot. The resistance levels are $2.134 and $2.159. Below the support comes in around $2.086 and $2.061. A close above August 1st’s high of $2.202 may signal a move to the range between $2.200 and $2.300. Until the market picks a direction, the safest place might be on the sidelines.

Today’s storage number is estimated to be an injection of 61 bcf. This is on the higher end of estimates, they range from 52bcf to 63bcf. Barring any major surprises in the injection, the path of least resistance is down. The low of this move is $2.029, anything beneath this level would be bearish. For a large majority of the continental U.S., weathers forecasts seem to be slightly below normal over the next week or so. Once again, the safest place to be right now might be on the sidelines until the market chooses a direction.