A recent rally on news of colder temperatures on the horizon throughout key growing areas of Brazil have prompted some major short-covering to take place in September coffee. Although there seems to be a huge question mark upon how cold temps will get, many shorts have stepped aside for the time being, allowing the bulls to step in.

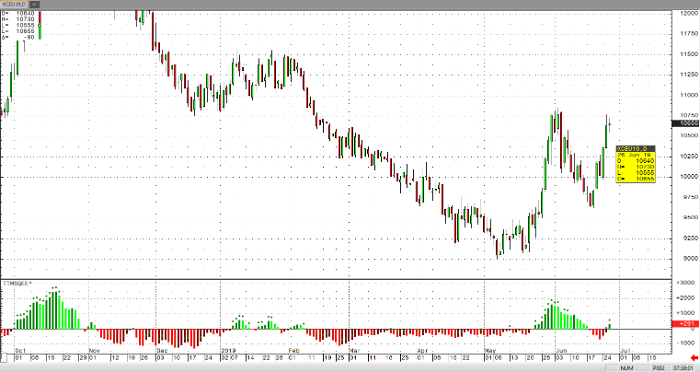

September coffee prices are quickly approaching a critical resistance area of 10860, the high from June 4th, which should slow rising prices down a bit. In support of those with bullish bias, a noticeable “higher-low” was put in by September coffee on June 19th. This higher-low may be suggesting that a temporary bottom has been put in place for September coffee. We’re also noticing rising momentum as the price action moves higher.

The Hightower Group has reported today that “stochastics are at mid-range but trending higher, which should reinforce a move higher if resistance levels are taken out”. A key area of resistance will be the aforementioned 10860 high from June 4th. If this level is taken out, we could see a revisit to highs not seen since February of this year.

Although this rally is noticeably admirable, and will no doubt tempt many bullish traders to cast their lines up river, the existing large supply of coffee on the world market will continue to be the huge “white elephant” in the room. Until a major threat of said supply gluttonies are realistically challenged, I remain neutral on September coffee prices and would expect some resistance at the 10860 level in the near term.

Coffee Sept ’19 Daily Chart