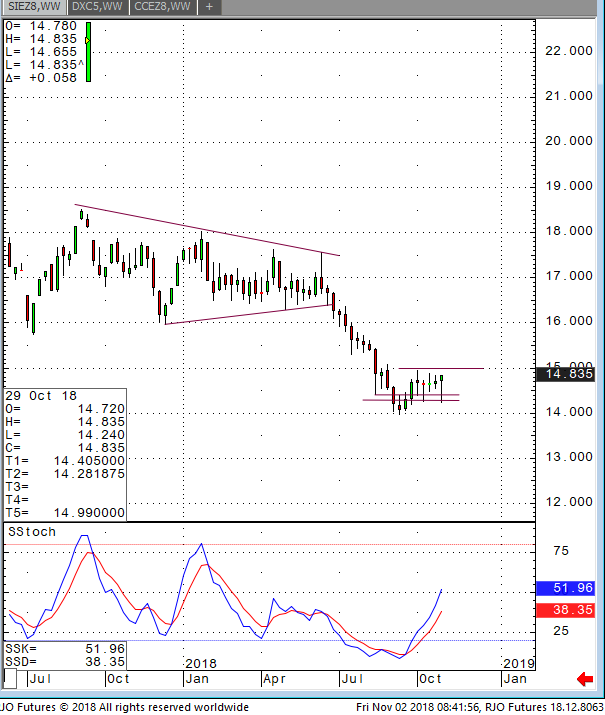

December silver is trading at $14.83, up 5 cents on the day. It appears that silver is looking to close “up” for the week. The chart below clearly demonstrates that silver looks to finish higher in “closing price” per weekly basis than the past eight weeks. All of this is a significant development and should put the silver “bears” on notice. As I have stated before, downside pressure for silver is waning, despite the overall long-term trade being down, I still think that higher prices possible in the coming weeks. A break above 15.00 is needed to attract more upside participants.

The US dollar index showing a “dark cloud” type of candlestick price action on the weekly basis indicates that more weakness is likely. The commitment of traders with options report (COT) measured on Oct 30th, getting released today, will most likely show lightening up of shorts of over 118K held as of Oct 23rd, 2018.

It is important to add that in previous blogs I mentioned that the gold/silver ratio is at a 25-year high. The last blog the spread moved to 83.72. I still think that my target is to breach 80.00 in the coming weeks. In short, Silver will be more of value over Gold.

As I have stated before, “from a technical perspective, a trade below (close below 14.25) on weekly bases could accelerate the downside momentum. In the December contract will accelerate downside momentum. Current upside target is 15.60 to 16.00. Again, from current levels of $14.60, mid 15.00 is likely if the market manages to stay above last week’s low of 14.25. Bullish Butterfly/bull call options with a limited risk might be ideal in this market, also again, Silver has 1000 once contract that is cash settled, an ideal for small accounts or those who want to test the water.

Silver Dec ’18 Daily Chart