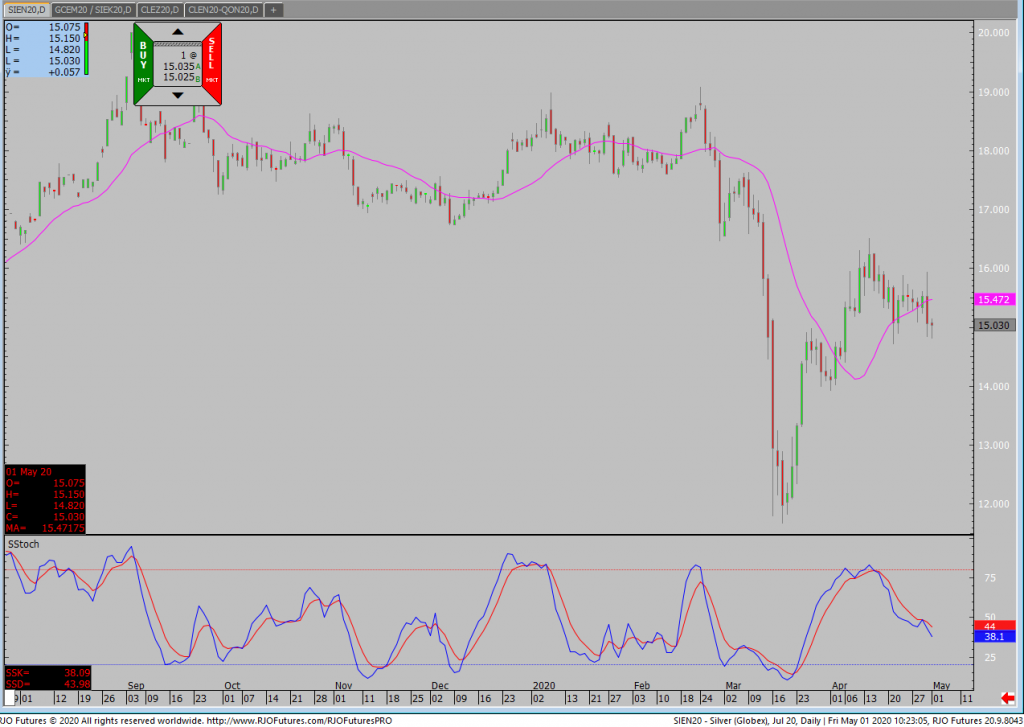

Silver rejected downside pressure and is trying to hold above $15.00 in the front month July contract. After gold/silver ratio hit a staggering high this March, silver is trying to avoid a steep sell-off that took silver below 12.00 last March. As I have stated before, silver is caught in the middle of demand/recession cycle. I still don’t anticipate a huge run up in price, but I do think that some technical levels could trigger an extended short term rally. For the futures, the July contract needs to hold above $15.00 to set another leg up. On the other hand, a shift in global recession sentiment could trigger another wave of selling that could pressure silver below $12.00.

In my view, the sooner we can get a resolution to COVID-19 and people start returning to work, the sooner you will see the price of silver stabilizing. A vaccine for COVID-19 would trigger a friendly rally for silver. Remember the Fed has pumped a lot of liquidity into the economy to make up for lost times. If you are patient, there will be “an inflation” rally. Right now, we are just grinding sideways. Taking a long and or short position could be premature. However, you can employ sideways strategy using options.