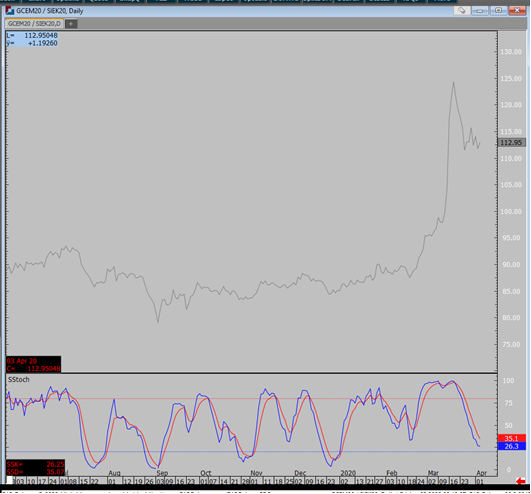

Silver rejected downside pressure and is trying to hold above $14.00 in the May contract. After the gold/silver ratio hit a staggering high in March, silver has started April well, relative to gold. Like most markets, silver is caught in the middle of demand/recession cycle. I don’t anticipate a huge run up in price but I do think that some technical levels could trigger an extended short term rally. For the futures, at least for the May contract, a high $14.98 needed to see low $17.00 Silver. On the other hand, a shift in global recession sentiment could trigger another wave of selling that could pressure silver below $12.00. In my view, the sooner we can get a resolution or phase type of return to work for most sectors, the sooner you see price of Silver stabilizing. It has been very interesting how each country is dealing with coronavirus, I’m sensing that more and more countries are taking drastic efforts for better outcome. Stay healthy stay safe.

Silver will be in sideways price action for the most part, if you like to learn to trade around it, reach out to me.