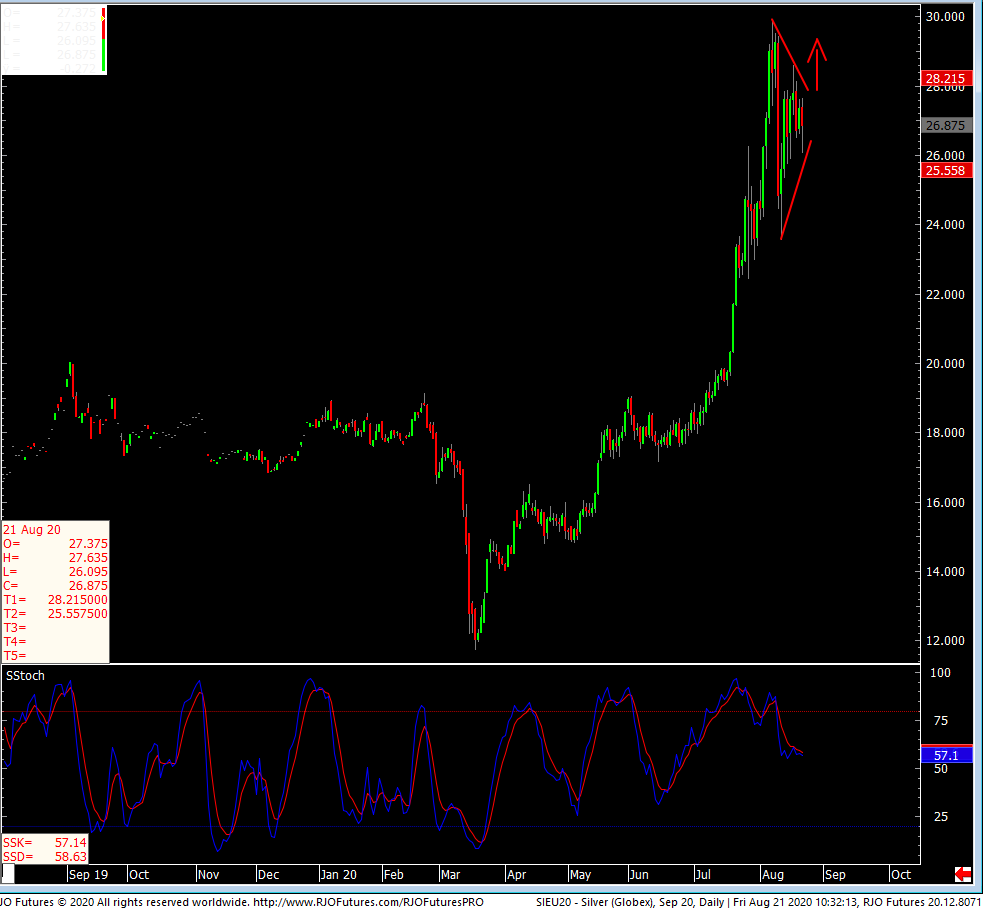

Front-month Silver is down 43 cents on the day trading at $26.73. Strong PMI and possibly strong existing home sales here in a few minutes will probably continue to give us a sense that the economy is slowly recovering from the pandemic. After being in free fall for several sessions, the U.S. dollar is showing a sigh of a corrective rally. Silver is still holding on regardless of dollar strength. Silver will probably continue to attract latecomers to the rally that has been trying to push and sustain silver above $30.00. Silver will continue to be sensitive to any signs of slowing down.

From a Technical perspective, silver needs to continue to hold above 2550 areas to keep off a sustained bear attach. A break below that level could trigger a wash below 25.00. a break above 28.00 will signal a continuation of the trend. Gold/Silver ration is sitting around 72.77 most likely, with a good silver showing, we can see a break below 70.00 soon in my view.

As I said before, the path of least resistance remains up. Silver continues to benefit over gold on this rally. The only thing that could slow down silver is recession type of economic data. My favorite saying, “ trade what you see, not what you think”. An option might be a way to approach this market. If you need additional help, please let me know. We can also approach this market using options as well as the 1000oz contract.