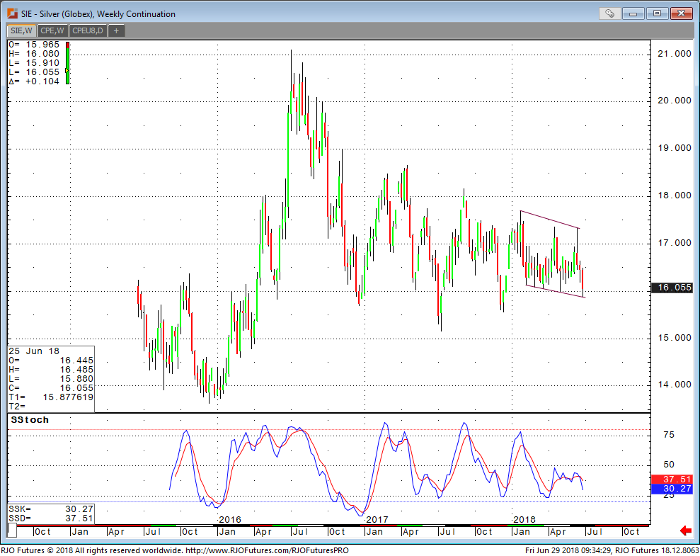

September silver is trading at 16.145, up about 10 cents on the day. The dollar is relatively weak, giving a lift to both gold and silver. The silver market is trying to recover from yesterday’s test of the psychological level of 16.000. As you see below in a weekly chart, silver is trading in a tight range. This chart formation suggests that a bounce is likely to take place to the upper end of the range. Crude oil is very strong, my take is that if the dollar sells off a bit here, it will lift all commodity markets in dollar terms. The silver gold ratio is sitting around 77.65 this morning. I have spent time discussing this in previous write-ups so I will not go into detail here but it suggests silver is cheaper.

This type of range trading environment provides a great deal of opportunity for trading silver options. Lack of direction could be frustrating to trade at times, options are handy tools if you master a few strategies. Silver is not trending right now. Again, as I write, the US dollar index is making a new low so that should benefit silver to hold this support line I drew on the chart below. Silver needs to trade above 16.50 to get the bulls excited. If the dollar recovers, low 15.00’s are likely.

Silver Weekly Continuation Chart